Advertisement|Remove ads.

Talen Energy Stock Falls Despite BofA’s Bullish Take Citing AWS Deal, Retail Optimism

Analysts at Bank of America (BofA) Securities initiated coverage of the Talen Energy Corp. (TLN) stock, giving it a thumbs up over possible gains from its recent data center deal and more.

According to TheFly, BofA analysts initiated coverage of the Talen Energy stock with a ‘Buy’ rating and a price target of $253. This implies an upside of over 14% from current levels.

Houston, Texas-based Talen Energy’s stock fell over 3% in morning trade on Monday. President Donald Trump’s tariffs on China, Canada, and Mexico have spooked investors, resulting in a broader decline in U.S. stock futures.

According to BofA analysts, Talen Energy’s recent deal with Amazon.com Inc. (AMZN) for an AWS data center contract for the Susquehanna nuclear power plant is lucrative.

They are also bullish on the newly proposed reliability-must-run (RMR) rates and the prospect of rising power prices, which would improve the company’s margins.

Despite the increasing competition in the energy market, BofA analysts believe higher capacity prices are “here to stay.”

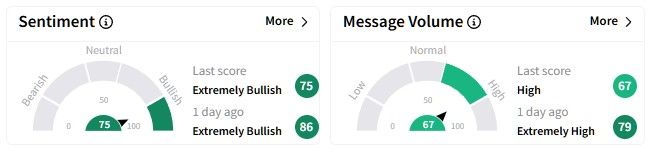

Retail sentiment on Stocktwits around the Talen Energy stock was in ‘extremely bullish’ (75/100) territory, and message volume was at ‘high’ levels at the time of writing.

One user thinks Talen Energy’s stock price and a few other energy stocks have “strong” support.

Talen Energy’s stock price has nearly doubled over the past six months, surging over 94%. It has more than tripled over the past year, with gains standing at nearly 230%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)