Advertisement|Remove ads.

Target Draws Retail Buzz Amid Renewed Buyout Speculation

Speculation that Target could be a likely candidate for a private-equity buyout sparked buzz for its stock on Stocktwits, on Wednesday.

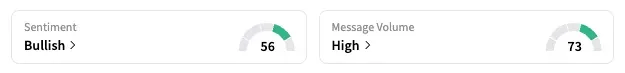

Retail sentiment shifted to 'bullish' as of early hours, from 'bearish' the prior day, and the 24-hour message volume jumped nearly 240%. That's after the stock rose 1% in Tuesday's session.

Business news outlet Seeking Alpha reported on Tuesday, citing a Fox Business story, that an unnamed private equity firm is eyeing Target amid buyout rumors that have been circulating since May. Stocktwits was unable to locate the original Fox Business report.

Nevertheless, retail watchers jumped in on the renewed speculation.

"No one is buying them out that i can see," a bullish user on Stocktwits said. "Maybe someone is buying a lot of shares, and it is pumping, but it looks a lot like Algo buying to me."

"$TGT let's see here, we have a PE buyout talk (prob 120-130) and congress buying the shares. Think we go much higher here," another user said.

The development comes amid a series of challenges for the big box retailer. Target's stock is down 31.6% year-to-date, heading for the worst yearly performance since 2021; a CEO transition is underway, with COO Michael Fiddelke set to assume the top role in February next year.

When Fiddelke was named for the CEO role in August, some analysts had said picking an outsider would have been a better choice.

Target's last quarterly report, released in August, showed comparable sales growing for the first time in a year, signaling that the business could be bouncing back.

Brokerages such as Gordon Haskett and Evercore ISI trimmed their price targets on TGT last month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)