Advertisement|Remove ads.

Target Stock Soars Amid Conservative Sales Outlook: Here’s How Retail Is Reacting

Target Corporation (TGT) stock surged over 15% pre-market after exceeding expectations in its Q2 earnings report, even as the company maintained a cautious outlook for the rest of the year.

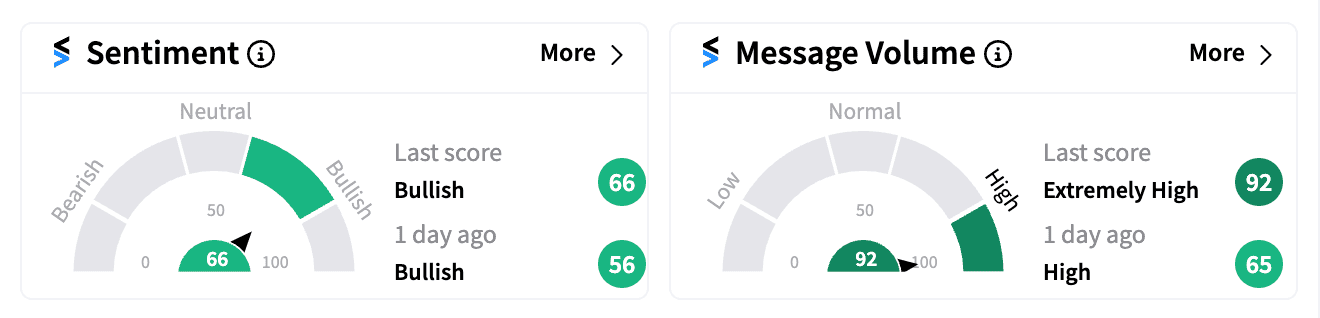

Retail sentiment on Stocktwits mirrored broader market optimism, as it jumped more into ‘bullish’ levels (66/100) accompanied by a surge in message volume.

Target's Q2 earnings per share of $2.57 surpassed analyst estimates of $2.18. Revenue of $25.45 billion also exceeded expectations of $25.19 billion.

Some retail investors are confident consumers haven't stopped spending and see potential for further growth.

The company ended a long streak of declining sales, indicating a potential turnaround after inflation and higher interest rates impacted discretionary spending.

CEO Michael Fiddelke attributed the company's improved performance to a "measured approach" in response to economic uncertainties.

But Target maintained its full-year sales forecast of flat to up 2% and expects the increase to be in the lower half of the range, citing difficulty in predicting consumer behavior in the current climate.

Walmart, which benefits from grocery and staple sales, increased its guidance in its latest quarterly earnings report, while Macy's, focusing on apparel and discretionary items, lowered its forecast. Home Depot and Lowe's also lowered outlooks due to the stagnant housing market.

On the positive side, Target raised its adjusted earnings per share guidance to $9.00 to $9.70 from $8.60 to $9.60.

At least four brokerages this month lowered their price targets on TGT. Stifel has the lowest price target of $147, which still represents a 2% upside from current levels.

TGT's stock is up 0.86% year-to-date. In comparison, Walmart (WMT) has gained 40%, Macy's has lost 20%, Home Depot (HD) has gained 6.43%, and Lowe's (LOW) has gained nearly 10%.

Read Next: Intuitive Machines Stock (LUNR) Flies High As Lunar Ambitions Fuel Retail Frenzy

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/2024-11-14t095510z-782457308-rc2w4baedem0-rtrmadp-3-reliance-power-renewable-enrgy-legal-2024-11-478736f8083567c30d6077a864034750-scaled.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_161161978_jpg_1bfd59def9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Astra_Zeneca_jpg_a49cc22562.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2020/11/enforcementdirectorate1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/28-exp-15-interior-2025-07-557b59240aa96521ceb4d2ec7b6d534c.jpg)