Advertisement|Remove ads.

Macy’s Cuts Full-Year Guidance, Misses Q2 Revenue Estimates: Retail Mood Sours

Department store Macy’s Inc (M) reported a mixed set of second-quarter results, with earnings beating Wall Street estimates but revenue falling short of expectations. Shares of the firm dipped 6% in Wednesday’s pre-market trading session.

Macy’s reported earnings per share (EPS) $0.53 versus an estimate of $0.30 but revenue declined 3% year-on-year (YoY) to $4.94 billion compared to an estimate of $5.12 billion. Net income came in at $150 million versus a loss of $22 million in the same quarter a year ago.

The firm’s gross margins increased to 40.5% during the quarter versus 38.1% last year.

The firm reduced its full-year net sales guidance to the range of $22.10 billion to $22.40 billion versus a prior guidance of $22.30 billion to $22.90 billion.

Macy’s said it updated its annual outlook to reflect a more discriminating consumer and heightened promotional environment relative to its prior expectations. “The company believes the outlook range provided gives the flexibility to address the ongoing uncertainty in the discretionary consumer market,” the company said in a release.

The department store also stated it will continue to focus on enhancing gross margin and exercising expense control to protect profitability while navigating ongoing macro headwinds.

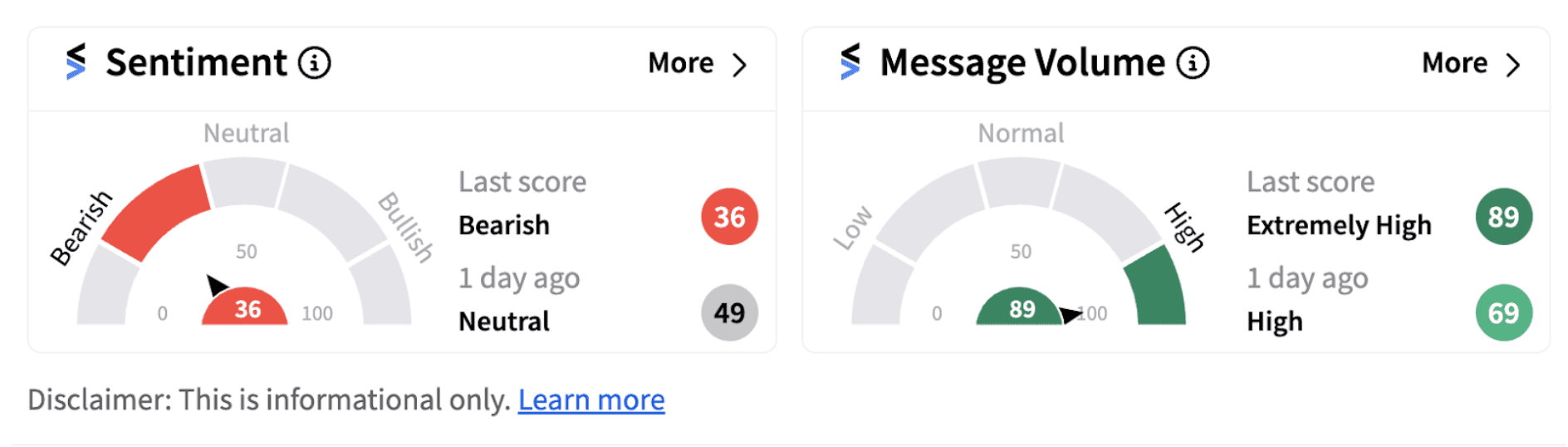

Retail sentiment on Stocktwits dipped into ‘bearish’ territory (36/100) from ‘neutral’ zone a day ago, accompanied by ‘extremely high’ message volume (89/100).

CEO Tony Spring told CNBC in an interview that customers aren’t spending as freely across all of Macy’s brands. “We see that there is definitely a softness, a carefulness, a delay in the conversion of purchasing,” he said.

Investors are now awaiting the rate cut cycle to begin which could help turnaround demand — something that retailers like Macy’s may be looking forward to. Some Stocktwits users are expressing disappointment at the sales forecast cut.

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/2024-11-14t095510z-782457308-rc2w4baedem0-rtrmadp-3-reliance-power-renewable-enrgy-legal-2024-11-478736f8083567c30d6077a864034750-scaled.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_161161978_jpg_1bfd59def9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Astra_Zeneca_jpg_a49cc22562.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2020/11/enforcementdirectorate1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/28-exp-15-interior-2025-07-557b59240aa96521ceb4d2ec7b6d534c.jpg)