Advertisement|Remove ads.

Tariff-Ravaged Reddit Stock Gets Bullish Recommendation On Growth Potential: Retail Sentiment Lags

Shares of community-focused social-media company Reddit, Inc. (RDDT) have pulled back notably from their record high of $230.41. The tariff uncertainty aggravated the sell-off set in motion by worries concerning the fundamentals.

With the stock languishing, analysts at Truist initiated coverage with a ‘Buy’ rating and a $150 price target, TheFly reported. The brokerage’s price target implies an upside potential of about 73% from current levels.

Truist said Reddit is one of the fastest-growing social media platforms, aggressively gaining share in the digital advertising market.

The brokerage added that the company has also shown material margin leverage, driving profitability, and it has more room to grow, given lower monetization relative to peers.

The firm said Reddit is also offering a differentiated product to users and advertisers with strong product market fit, which is reflected in the company’s solid daily active user growth and growing engagement.

After a broad consolidation move that followed the March 21, 2024, initial public offering (IPO), Reddit stock took off in late October. The trigger was a surprise profit reported for the third quarter of the fiscal year 2024.

The rally extended until the middle of February, when the stock traded up in anticipation of another stellar report from the Alex Ohanian-co-founded company.

However, investors bid down the stock despite the headline beat as a slowdown in user growth metrics set off worries. Reddit led from the front as the broader market began to reverse course in mid-February, dragged by Trump tariff concerns.

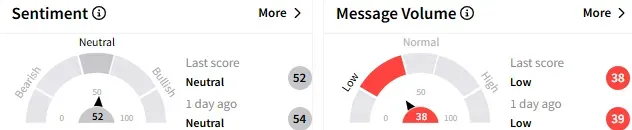

On Stocktwits, retail sentiment toward Reddit stock remained ‘neutral’ (52/100), and the message volume continued to be ‘low.’

A bearish user said the Reddit stock is only worth $30 as mass banning and censorship have driven away ad revenue.

On the other hand, another user said the stock could rocket back to $112 this week,

Reddit stock fell 5.65% to $82 in Monday’s premarket trading. The stock is down about 47% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)