Advertisement|Remove ads.

Breakout Radar: SEBI RA Kavita Agrawal Sees Reversal In Tata Elxsi, Rally Setup In Dixon Tech

SEBI-registered analyst Kavita Agrawal has flagged two stocks for a potential breakout. Dixon Technologies and Tata Elxsi appear poised for further upside, as indicated by their technical charts.

1. Tata Elxsi

On June 28, Tata Elxsi shares showed signs of a possible trend reversal on the 75-minute chart.

She highlighted that the recent downtrend appears to have paused, as no new lows were recorded, and showed the first signs of a relief rally. Agrawal pegged the 250-day exponential moving average (EMA) at ₹6,396 as the key level to watch for a breakout on Tata Elxsi.

Additionally, there is a positive divergence in the Relative Strength Index (RSI), which shows that momentum is building.

For traders considering a breakout setup, she recommended entering above ₹6,396 with a target at ₹7,600. The stop loss is set at ₹6,000, offering a solid risk-reward ratio of 3:4.

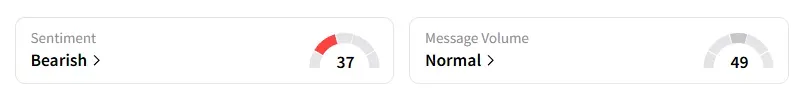

Data on Stocktwits shows that retail sentiment turned from ‘neutral’ to ‘bearish’ a day ago.

Tata Elxsi shares have fallen 7% year-to-date (YTD).

2. Dixon Technologies

Agrawal highlighted that Dixon Technologies shares witnessed a false breakout alert on June 28, as the stock failed to sustain its upmove and is now back at a strong support zone.

She recommends watching ₹15,000 for a breakout. A clean move above this level with strong volumes could trigger a fresh rally to ₹19,000 (a potential 36% upside based on historical trends), according to Agrawal.

Key factors to watch include a sustained breakout and a rise in volumes. Dixon remains on her swing watchlist, with a trading opportunity if the stock breaks out.

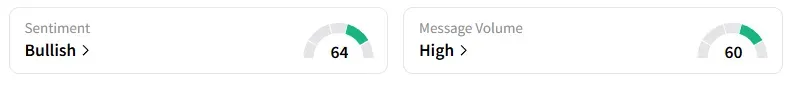

Data on Stocktwits shows that retail sentiment has remained ‘bullish’ for a week.

Dixon Technologies has gained 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)