Advertisement|Remove ads.

Tata Elxsi Shares: SEBI Analysts See Bullish Setup, AI Strategy As Key Growth Driver

Tata Elxsi shares have risen 7% in the last five sessions. SEBI-registered analyst Pradeep Carpenter partly credited this rise to a technical bullish reversal, but also added that the broader IT sector’s momentum has supported the buying sentiment.

Indian IT stocks are witnessing profit booking on Thursday, following renewed buying this week on the back of a weaker rupee that boosts export revenues, short-covering by foreign investors, and expectations of higher technology spending in global markets.

At the time of writing, Tata Elxsi shares were down over 1% on Thursday.

Technical Watch

Carpenter highlighted that the stock has recently displayed a bullish setup on its daily chart, forming a textbook Bullish Gartley Harmonic pattern. The structure is well-defined, and charts indicate that the region around ₹5,210 is a potential reversal zone.

According to the harmonic framework, Carpenter advised that entry is favorable near this level or on a breakout above ₹5,660, with defined targets of ₹6,100 and ₹6,725. A sustained move below ₹5,210 would, however, invalidate the pattern and act as a stop-loss level.

Fundamental Watch

From a fundamental standpoint, Tata Elxsi is not a typical IT services provider but rather a specialized engineering R&D and design-led firm with involvement in automotive, media, healthcare, and digital transformation sectors.

The company remains financially strong, with robust return ratios. It maintains a debt-free balance sheet with no promoter pledging. Earnings, however, have faced some pressure in recent quarters. The management has guided for recovery in the second half of FY26, supported by new deal wins in the automotive and healthcare verticals.

Growth Triggers

According to Carpenter, a long-term growth pillar for Tata Elxsi is its deep focus on artificial intelligence (AI) integration across its core business verticals.

Analyst Vishal Trehan also flagged the company’s recent partnership with Bayer, a sign of its diversification away from automotive and media. While it boosts Bayer's ability to deliver reliable, high-precision devices that improve patient outcomes, it also allows Tata Elxsi to deepen its footprint in life sciences.

Analyst Outlook

Overall, Carpenter believes that Tata Elxsi is a strong bet with favorable risk-reward dynamics. And its AI-driven strategy in automotive, OTT, and healthcare makes it a differentiated play within the IT and ER&D landscape. He advised investors to watch for sustained confirmation above key levels, as the stock appears well-positioned to retest higher zones if market and sectoral conditions remain supportive.

What Is The Retail Mood?

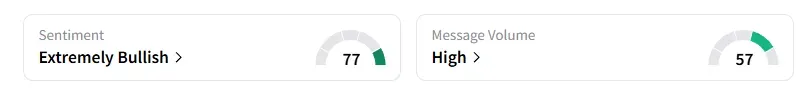

Data on Stocktwits shows that retail sentiment has been ‘extremely bullish’ amid ‘high’ message volumes for a week now.

Tata Elxsi shares have declined 15% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)