Advertisement|Remove ads.

Tata Motors Bounces From Lows: SEBI RA Dhwani Patel Flags ₹796 As Next Key Level To Watch

Tata Motors’ shares are showing signs of recovery after falling nearly 40% from their 52-week high, drawing attention from traders and analysts. The stock has also been on Stocktwits’ ‘watched’ list, which tracks scrips with the most new watchers in the last 24 hours.

SEBI-registered analyst Dhwani Patel observed that Tata Motors has rebounded from the ₹560 level. The stock has reclaimed both the 20 and 50-day Exponential Moving Averages (EMAs), indicating short-term strength. However, the 200-day EMA at ₹744 continued to act as a strong resistance.

A Fibonacci retracement from the ₹1179 high to ₹560 low placed the stock price near the 23.6% retracement level, while the 38.2% retracement at ₹796 is identified as the next key level to watch, she added.

Technical indicators, such as the Directional Movement Index (DMI), indicated mild strength. Patel noted that the stock needs to see sustained movement above ₹706 for momentum to continue, while the ₹670-675 range is seen as a critical support zone in case of any pullback.

Tata Motors reported its June sales data earlier this week, and it has witnessed a decline across all categories. Domestic sales fell 12% from the year-ago period to 65,019 units in June. Commercial Vehicle sales declined by 5%, while sales of passenger vehicles, including electric cars, in the domestic market were down 15%.

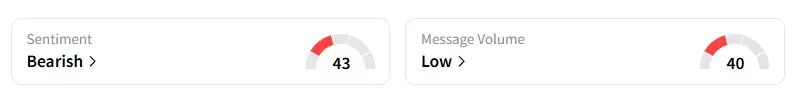

Data on Stocktwits shows that retail sentiment turned ‘bearish’ a week ago on this counter.

Tata Motors shares have fallen 7% year-to-date (YTD)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)