Advertisement|Remove ads.

Tata Motors Falls Post Q4, But SEBI RAs Eye Reversal And Fresh Upside

Tata Motors’ stock came under pressure following its fourth-quarter earnings, falling nearly 2% on Wednesday.

Aditya Hujband, a SEBI-registered research analyst, said the company had managed to deliver steady revenues and resilient core operations, which helped absorb the absence of last year’s tax benefits and some one-off items.

However, he flagged that no major catalysts had emerged this quarter to fuel upside in the near term.

From a technical standpoint, Hujband highlighted that Tata Motors continued to trade above its 7-, 21-, and 50-day exponential moving averages (EMAs), signaling short- to mid-term bullish momentum.

The Relative Strength Index (RSI) stands at 58.64, indicating moderate strength in the stock without entering overbought territory, thereby suggesting there is still room for further upside movement.

Additionally, Tata Motors' price is approaching the upper Bollinger Band, a development that often precedes either a period of consolidation or a potential breakout. The stock is also forming a higher high–higher low pattern, a classic indicator of an ongoing uptrend.

Hujband identified immediate resistance at ₹725; a decisive breakout above this level, especially if supported by strong trading volumes, could trigger a fresh rally.

Beyond this breakout zone, further resistance levels are noted at ₹800 and ₹950, while support is established at ₹650.

Hujband's technical view underscores the importance of monitoring volume around the ₹725 mark for confirmation of a sustained upward move.

Meanwhile, Karanraj Sonkusale echoed a broadly bullish medium-term outlook. According to his analysis, Tata Motors exhibited a strong technical structure.

He recommended accumulating the stock in the ₹700–₹710 zone with a stop-loss at ₹660 to manage risk. His upside targets include ₹780, followed by ₹955, and a longer-term target of ₹1,060.

However, not all signals pointed upward. Analyst Anupam Bajpai observed that in April, Tata Motors had formed a candlestick pattern outside the lower Bollinger Band, often a sign of potential price reversals. While this initially suggested a bounce, Bajpai pointed out that the momentum failed to sustain.

Bajpai notes that the price may move toward the significant support at ₹683, with the 50-day exponential moving average, currently at ₹656, acting as a crucial support level in the near term.

Despite the current weakness, the consensus among analysts is that Tata Motors’ underlying strength remains intact.

Recent optimism has been fueled by the India-UK Free Trade Agreement (FTA), which could ease export barriers for Jaguar Land Rover (JLR), Tata Motors’ luxury vehicle arm.

Additionally, the company received an overwhelming mandate from its shareholders to demerge its commercial vehicle and passenger vehicle businesses.

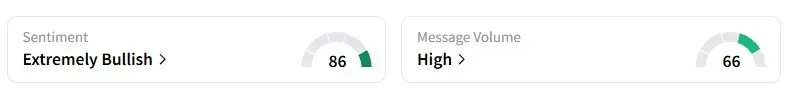

Retail sentiment too remains ‘extremely bullish’ on the counter, according to data from Stocktwits.

Tata Motors shares fell 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)