Advertisement|Remove ads.

Tata Motors Near Breakout Zone After 17% Monthly Rally: SEBI RA Prameela B Says ₹720 Is The Level To Watch

Tata Motors is gaining investor traction as its stock inches closer to a crucial technical breakout level.

After climbing nearly 9% in the past week and 17% over the last month, the stock is currently testing the ₹720 mark — a key resistance zone that, if breached, could set the stage for a sharp 8-10% upside rally, according to SEBI-registered analyst Prameela Balakkala.

Balakkala highlights that Tata Motors has rebounded strongly following a phase of healthy consolidation. Technical indicators—including price action challenging a downtrend line and improving momentum—suggest growing bullish sentiment.

On the fundamental side, Balakkala highlights several recent developments that support a positive outlook.

The India–UK Free Trade Agreement (FTA) is expected to benefit Tata Motors, particularly its Jaguar Land Rover (JLR) division, by easing export norms and boosting demand for premium vehicles.

The FTA will sharply reduce import duties on UK-made cars, making JLR models more competitive in the Indian market and likely increasing their sales

Additionally, Tata Motors’ shareholders have approved the demerger of the commercial vehicle business on May 6, a strategic move intended to unlock value and sharpen the company’s focus across its business verticals.

Market sentiment is further lifted by speculation around a potential US–UK trade deal, which could further expand JLR’s global reach.

Overall, Balakkala’s analysis suggests that both technical and fundamental factors are aligning in favor of Tata Motors, positioning the stock for potential gains if it can clear the crucial ₹720 resistance level.

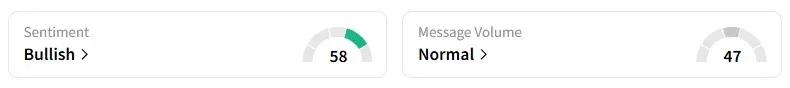

Data on Stocktwits shows retail sentiment is ‘bullish’ on this counter.

Tata Motors shares have fallen 6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)