Advertisement|Remove ads.

Tata Technologies Q1 Preview: Stock Eyes Breakout, SEBI RA Sees Support At ₹700

Tata Technologies appears to be consolidating ahead of reporting its first-quarter (Q1FY26) results on Monday.

Brokerages expect a decline in revenue and margins, while investors watch for cues on growth momentum. The company had recently partnered with Emerson to enhance next gen mobility testing solutions, however its exposure to JLR could pose a short-term risk, according to analysts.

The stock is setting up for a potential breakout as it consolidates above a strong support zone after reversing from its downtrend, according to SEBI-registered analyst Rohit Mehta. On the daily chart, the stock has moved out of a falling channel that extended from September 2024 to April 2025.

Since the breakout, it has been holding steady above the ₹680 - ₹700 zone, a level that now acts as firm support. The trade pattern is hinting at a “base-building” structure rather than a short-lived bounce, the analyst said.

This technical resilience is backed by improving fundamentals. The company is virtually debt-free, offers a 70% dividend payout ratio, and has significantly improved its working capital cycle from 55.4 to 37.2 days. However, valuations remain steep, with the stock trading at 8.03x its book value.

Investor shareholding trends remain broadly stable, though domestic institutional investor (DII) holdings have dipped slightly. Overall, Tata Tech is transitioning from a bearish to a sideways trend, and a sustained move above ₹725 - ₹730 could unlock the next leg higher.

At the time of writing, Tata Technologies’ stock was down 0.35% to ₹704.95 and has shed a fifth of its value year-to-date (YTD).

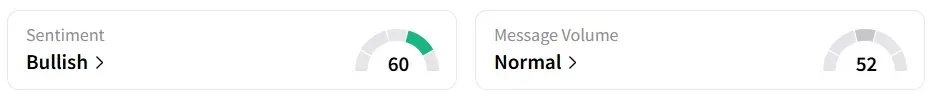

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week earlier.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)