Advertisement|Remove ads.

Taxed Even When You Lose? Gamblers Cry Foul Over Provision In Trump’s ‘Big Beautiful Bill’

Gamblers are raising alarm over a tax provision for the industry in President Donald Trump's "One Big Beautiful Bill Act," which passed the Senate vote on Tuesday, according to a Bloomberg report.

The mega bill states that gamblers would only be able to deduct 90% of their losses when calculating their net income for tax purposes. The current law allows the deduction of the entirety of their losses, up to the amount of their gambling winnings.

Pro poker player Phil Galfond raised concern on social media site X and hit back, saying, "You get taxed on more than you earned from gambling, even if you netted $0 (or less!)"

The sector has gained popularity in the U.S. recently, drawing professionals as well as newcomers, fueled by the rise of online platforms such as FanDuel, DraftKings (DKNG), and Kalshi.

The industry clocked $72 billion in U.S. commercial gaming revenue in 2024, according to the American Gaming Association.

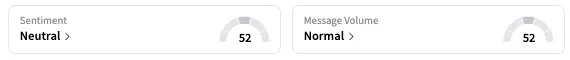

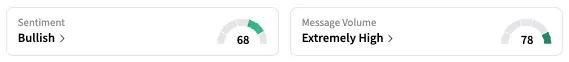

On Stocktwits, the retail sentiment was 'neutral' for DraftKings and 'bullish' for Sports Betting & iGaming ETF (BETZ), which tracks gambling stocks.

BETZ has gained a mere 0.6% in the first six months of 2025 after climbing 24.6% last year, while DKNG shares have lost 3.6%.

Zachary Zimbile, an account with experience in gambling regulations, told Bloomberg that many of his clients were concerned about the provision. "If you add a 10% penalty, it's going to eat into a lot of their profit," he said.

Representative Dina Titus, a Democrat who represents the Las Vegas area, has vowed to take up the issue as it would have a "big impact" on the betting industry.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)