Advertisement|Remove ads.

TCS Q1 Margins Hold, Revenue Falters: SEBI RAs See Caution Ahead, Advise Watching ₹3,740 Breakout Level

Tata Consultancy Services (TCS) kicked off first quarter (Q1FY26) earnings with a mixed bag: stronger profitability and margin defense, but muted topline performance.

SEBI-registered analyst Rajneesh Sharma added that the company’s conservative tone matches the cautious global mood, especially in tech spend from the US.

TCS Q1 revenues rose 5.4% to ₹63,438 crore year-on-year (YoY), while profit rose 8.7% to ₹12,829 crore. Operating margins stand at 24.6%. The company has announced a ₹11/share interim dividend.

Sharma flagged that constant currency growth was slowing down at TCS, coming in at 4.1%, compared to 5.4% in Q4 FY25 (YoY). The management acknowledged “weak macro and client caution,” particularly in discretionary tech spends.

Q1 Segment Performance: BFSI Recovers, CMT Contracts

BFSI (Banking, Financial Services, and Insurance): Demonstrated a sequential rebound, revenue increased to ₹24,736 crore from ₹23,978 crore, aligning with previous guidance of "early signs of recovery."

CMT (Communications, Media, and Technology): Experienced a sharp decline, with revenue falling from ₹11,022 crore in Q4 to ₹9,436 crore in Q1.

Manufacturing & Retail: Revenue remained largely flat quarter-over-quarter.

North America: Continued softness was observed, validating earlier commentary that "cautious demand" would persist into H1 FY26.

Management had previously guided for EBIT margins to remain near 24–25%, a gradual recovery in BFSI, continued softness in CMT, and a focus on early-stage GenAI investments with delayed monetization.

Sharma observed that in Q1 FY26, TCS delivered on several fronts: EBIT margin was maintained at 24.5–24.6%, aligning with prior guidance. The BFSI segment showed sequential recovery, but the CMT vertical underperformed, experiencing a double-digit quarter-on-quarter decline, which was worse than expected. Additionally, no clear monetization breakout in the AI pipeline was reported.

On the technical charts, TCS shares closed down from their February 2024 high of ₹4,600, and are now forming a potential higher low at ₹3,140. Sharma added that it is facing resistance between ₹3,528 and ₹3,742 (which is 200-week Exponential Moving Average (EMA), 100-week, 50-week EMA), with support zones at ₹3,348.85 and a base at ₹2,980.

Its Relative Strength Index (RSI) stands at 38.5, showing bullish divergence, and a rising wedge pattern is visible, indicating the need to watch for a breakdown or breakout.

Sharma said that the medium-term bias remained bearish unless the stock broke ₹3,740, while the long-term outlook remained rangebound to bullish as long as the stock stays above ₹3,000.

He concluded that TCS has shown strength where it matters: margin discipline, profit growth, and select vertical recoveries. But flat revenues, CMT weakness, and lack of AI monetization progress warrant caution.

Technically, the stock is approaching a heavy resistance cluster and a breakout above ₹3,740 would be meaningful. Until then, he advised monitoring rather than aggressive buying.

Analyst Financial Independence remains neutral to positive on TCS. They believe that its Q1 profits and hiring strength (net addition of 5,090 employees) are positives, but the softness in revenues signals macro headwinds in key verticals.

Analyst SharesNServices noted that there was no negative surprise in the earnings. On the technical side, they pegged support between ₹3,340–₹3,380 for TCS, with the final backing at ₹3,180–₹3,220 if it breaks below the previous levels. Resistance is seen at ₹3,440, ₹3,490, and ₹3,540. They advised watching for a breakout above ₹3,540, which could show a bullish ‘Inverse head and shoulder’ pattern in play for ₹3,800-₹4,000 targets. Monitor for reversal near ₹3,360 and a breakout confirmation.

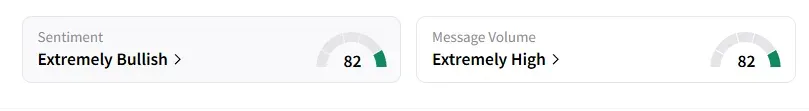

Data on Stocktwits shows that retail sentiment is ‘extremely bullish’ on TCS amid ‘very heavy’ message volumes.

TCS shares have declined 16% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_92efa5a8c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)