Advertisement|Remove ads.

Why Did Ferroglobe Stock Surge 18% On Tuesday?

- The European Union imposed country-specific tariff-rate quotas on certain ferroalloy imports, limiting volumes that can enter duty-free.

- EU probe found that rising imports were hurting EU producers, whose market share fell to 24% in 2024.

- GSM stock recorded its highest intra-day percentage jump since March 2022.

Shares of Ferroglobe Plc (GSM) surged by more than 18% on Tuesday after the European Union imposed safeguard measures on imports of certain ferroalloys.

GSM stock recorded its highest intra-day percentage jump since March 2022 and traded above its 200-day moving average (DMA) again after a week.

EU Safeguard Measures

On Tuesday, the European Commission introduced definitive safeguard measures to protect the EU’s ferroalloy industry, which employs around 1,800 people. After an 11-month investigation, the EC imposed country-specific tariff-rate quotas on certain ferroalloy imports, limiting volumes that can enter duty-free.

The probe found that rising imports, up 17% between 2019 and 2024, were hurting EU producers, whose market share fell to 24%.

Accordingly, the EC ruled that imports exceeding the quota may still enter the EU duty-free if they are priced above a defined minimum threshold. However, if the price falls below that threshold, importers must pay a duty equal to the difference between the actual price and the required minimum. These safeguard measures will remain in effect until November 2028.

How Does It Impact Ferroglobe?

The company, which has production units in Europe, came under pressure this year due to the import of cheap Chinese alloys.

Ferroglobe’s third-quarter sales fell 28.1% to $311.7 million, with CEO Marco Levi attributing the decline to challenging market conditions due to “aggressively low-priced imports to the EU”.

With the latest EU measures, Ferroglobe expects an upturn in its European business.

“We expect the final EU trade measures to be announced later this month. Together, these trade measures should help domestic producers regain market share. As the leading domestic producer in both Europe and the U.S., we are optimistic that 2026 market conditions will be significantly more favorable for Ferroglobe,” Levi had said earlier this month.

How Did Stocktwits Users React?

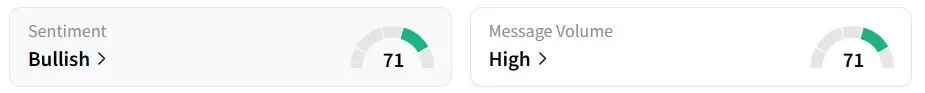

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier, accompanied by ‘high’ message volumes.

One user expects the stock price to more than double from current levels.

Year-to-date (YTD), GSM stock has gained more than 11%.

Read also: BTC Price Rebounds To $91,000 After $1 Billion Crypto Liquidation Wave

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)