Advertisement|Remove ads.

QQQ Slides As ‘Mag 7’ Stocks Sink Amid Rising Bond Yields: Retail Shifts To Neutral

Tech stocks led the stock market lower Wednesday afternoon, with the Invesco QQQ Trust ($QQQ) down sharply. The exchange-traded fund that tracks the Nasdaq 100 Index, appears on track to snap a five-session losing streak.

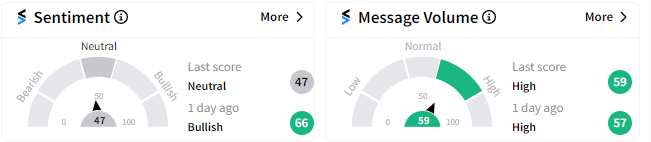

On Stocktwits, retail sentiment has turned ‘neutral’ (47/100) as of 2:00 pm ET, reversing course from ‘bullish’ a day ago. Message volume, however, continued to remain ‘high.’

QQQ’s drop came amid sharp pullbacks in all seven Magnificent 7 stocks, led by Nvidia Corp. ($NVDA). Tesla, Inc. ($TSLA), which is due to report its earnings after the close, also clocked steep losses.

The declines followed a rise in bond yields, which reflected market expectations for less aggressive Fed rate cuts.

Some recent economic data vouched for the economy’s resilience, and the futures market is pricing in a 92.4% probability of a 25 basis-point cut at the November Federal Open Market Committee meeting.

The benchmark 10-year Treasury note yield ticked up 3.6 basis points to 4.242%, off the day’s high of 4.264%, which marked the highest mid-July.

The near-term sentiment largely depends on some key earnings reports that are due over the course of the reporting season, especially from the tech and communication services space.

Thursday will bring its fair share of Main Street data, including the weekly jobless claims, S&P Global’s flash private sector activity data for October and new home sales.

As of 2 pm ET, QQQ fell 2% to $486.06 and the SPDR S&P 500 ETF Trust ($SPY), which tracks the broader S&P 500 Index, slipped a more modest 1.31% to $575.68.

Read Next: Tesla Q3 Earnings Loom After Market Close, But Retail Crowd Tunes Out As Bearish Sentiment Builds

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)