Advertisement|Remove ads.

Tesla Q3 Earnings Loom After Market Close, But Retail Crowd Tunes Out As Bearish Sentiment Builds

Electric-vehicle giant Tesla, Inc. ($TSLA) is expected to report its much-awaited third-quarter earnings after the market closes on Wednesday, but retail sentiment toward the stock has remained bearish for a while.

Key Numbers

Analysts, on average, expect the company to report non-GAAP earnings per share (EPS) of $0.59 vs. $0.66 reported for a year ago and $0.52 earned in the previous quarter.

The Elon Musk-led company is set to report its third straight quarter of earnings decline as price cuts and incentives aimed at boosting the topline hurt margins.

Revenue is estimated at $25.47 billion, up from the $23.35 billion reported for the year-ago quarter and nearly flat with the preceding quarter $25.50 billion.

Apart from these headline numbers, the focus is likely to be on the auto gross margin, excluding regulatory credits, also called core gross margin.

Fund manager Gary Black, a Tesla bull, models core gross margin of 14.2% compared to the consensus estimate of 14.9%, attributing his below-consensus view to Tesla’s 0.99% promo loan rate offered globally.

Tesla doubled its energy and storage revenue year-over-year in the second quarter to $3.01 billion, or roughly 12% of the total revenue.

Q3 Deliveries

Earlier this month, Tesla reported third-quarter deliveries of 462,890 units, falling below Wall Street’s so-called “whisper number” estimate.

Earnings Call Focus

Traders may look ahead to forward deliveries guidance on the earnings call hosted by the management at 5:30 pm ET. Musk has hinted at growth from the 1.81 million units delivered in 2023, which leaves the company with a tall order of selling 514,925 EVs in the fourth quarter.

Other focus areas are updates on timeline for robotaxi launch and a sub-$30,00 EV, the fructification of unsupervised full self-driving, and the core gross margin guidance.

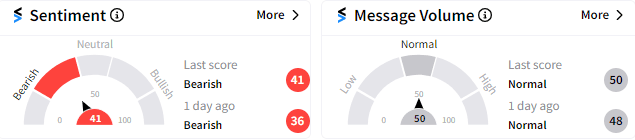

On Stocktwits, sentiment score for Tesla was 41/100 as of 12:30 pm ET, suggesting ‘bearish’ mood, and message volume remained ‘normal.’

Retail traders see the stock trading out of sync with weak fundamentals

Tesla Stock

As of 12:30 pm ET, Tesla stock traded down 1.68% to $214.30. It is trading well off its all-time closing high of $409.97 reached on November 3, 2021.

Read Next: Texas Instruments Stock Rises On Solid Q3 Results But Retail Sentiment Nosedives

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)