Advertisement|Remove ads.

Tesla Reportedly Struggles In Europe With 89% Sales Drop In Sweden

- October sales were cut nearly in half in Norway and the Netherlands, and fell by about a third in Spain.

- In Sweden, Tesla registered just 133 new vehicles in October, representing an 89% year-on-year (YoY) decline.

- Only France posted a modest rebound, with registrations up 2.4%.

Tesla Inc. (TSLA) is facing a tough time in Europe as electric vehicle sales continue to slide across key markets.

The company has seen sharp declines in registrations throughout the continent, signaling persistent demand challenges for the automaker led by Elon Musk.

Sales Across Europe

According to a Bloomberg report, in Sweden, Tesla registered just 133 new vehicles in October, an 89% year-on-year (YoY) drop. Similar downturns were seen elsewhere in Europe, with sales cut nearly in half in Norway and the Netherlands and falling by about a third in Spain.

Only France posted a modest rebound, with registrations up 2.4%, although that follows a 47% YoY decline in October 2024. Through the first ten months of 2025, Tesla’s French registrations were still down by around 30%, according to the report.

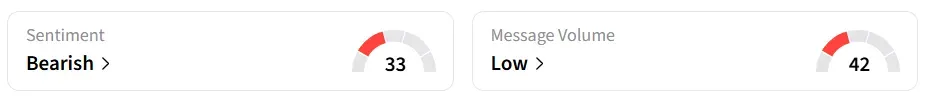

Tesla stock traded over 2% higher on Monday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory. Message volume shifted to ‘low’ from ‘high’ levels in 24 hours.

Struggles Deepen Despite Record U.S. Quarter

According to a Reuters report, Tesla’s European sales had briefly rebounded in September after months of decline; however, October figures indicate renewed weakness. The company’s record-setting third-quarter (Q3) sales were primarily fueled by a surge in U.S. buyers seeking to claim federal EV tax credits of $7,500 before their September 30 expiration.

In Germany, Europe’s largest automotive market, electric vehicle registrations rose 38% during the first nine months of 2025. Tesla, however, saw its own sales in the country drop by 50% over the same period.

In Denmark and Spain, Tesla was overtaken by several Chinese electric vehicle makers, including BYD Co. (BYDDY), Xpeng Inc. (XPEV), and Geely-owned Zeekr, according to the report.

Tesla stock has gained 16% in 2025 and 93% in the last 12 months.

Also See: Why Did BMNR Stock Fall 7% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233231242_jpg_8d76eb3b7a.webp)