Advertisement|Remove ads.

Why Did BMNR Stock Fall 7% Today?

- BitMine’s ETH assets alone account for about 2.8% of the total Ethereum supply.

- The company’s combined crypto, cash, and “moonshot” assets now total an estimated $13.7 billion.

- Bitcoin’s price moved 3% lower, and Ethereum’s price fell 7% in the last 24 hours.

BitMine Immersion Technologies (BMNR) announced on Monday that its combined crypto, cash, and “moonshot” assets now total an estimated $13.7 billion, down from the $14.2 billion value as of October 27.

The company focuses on building long-term crypto holdings, mainly in Bitcoin (BTC) and Ethereum (ETH). It acquires assets through its own mining operations and through the raising of capital.

Crypto Footprint

As of November 2, the company’s portfolio included 3,395,422 ETH at $3,903 per ETH, 192 BTC, $62 million in Eightco Holdings Inc. (ORBS), and $389 million in unrestricted cash.

The firm’s ETH assets alone account for about 2.8% of the total Ethereum supply. BitMine’s total crypto holdings place it second only to Strategy Inc. (MSTR), which owns roughly 640,000 BTC valued at over $70 billion.

Following the announcement, BitMine’s stock traded 7% lower by mid-morning on Monday. The stock was also dragged down by a fall in both BTC and ETH prices. Bitcoin’s price moved 3% lower, and Ethereum’s price fell 7% in the last 24 hours.

What Are Stocktwits Users Saying?

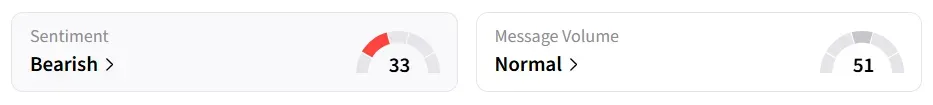

On Stocktwits, retail sentiment around BitMine Immersion stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

A bearish Stocktwits user predicted that BMNR stock could reach $20 this week.

Another user highlighted the crypto market decline on Monday.

“Crypto suffered its largest ever liquidation event on October 10th, and open interest on ETH (per coinalyze.net fell -45% in the past 8 weeks (the largest ever decline in the history of ETH).”

-Thomas "Tom" Lee of Fundstrat, Chairman, BitMine

“This reset is healthy and sets the stage for price and fundamentals to eventually converge,” he said.

BitMine Immersion stock has gained over 442% in the last 12 months.

Also See: BYND Stock Plummets 13% Today: What’s Driving The Decline?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)