Advertisement|Remove ads.

Tesla Stock Jumps After China VP Torches ‘China-Free’ Supply Chain Rumors — Boasts Shanghai Cranks Out The World’s Cheapest Model 3 And Y

- Tao pushed back against reports claiming Tesla was phasing out China-made parts for its U.S. factories.

- She highlighted Shanghai’s manufacturing strength and said local buyers get the Model 3 and Model Y at the ‘lowest price in the world.’

- The earlier report said Tesla had encouraged some Chinese suppliers to shift production to Mexico and Southeast Asia amid tariff pressure and chip disruptions.

Tesla, Inc. shares moved higher after a public statement from Tesla China Vice President Grace Tao countered claims that the company is pursuing a “China-free” supply chain for vehicles built in the U.S. Her comments also highlighted Shanghai’s cost advantages and her assertion that the Model 3 and Model Y sold domestically are priced at the “lowest price in the world.”

The stock rose 1.7% on Wednesday to $426.58, marking its third straight session of gains, and stayed flat in after-hours trade.

Grace Tao’s Rebuttal To Supply Chain Claims

In a statement on Weibo, Tao said Tesla follows identical supplier selection criteria across all of its major manufacturing hubs, including the U.S., China and Europe. She emphasized that suppliers are chosen strictly on quality, total cost, technical maturity and long-term stability. According to her, country of origin does not play any role in excluding suppliers, which is seen as a direct challenge to claims that Tesla had begun reducing the use of China-made components for U.S.-built vehicles, Tesla investor and influencer Sawyer Merritt posted on X.

Tao framed Tesla’s sourcing approach as consistent worldwide, rejecting the idea that the company was imposing political filters on its procurement decisions. She said that supplier origin “does not constitute an exclusion criterion.”

Shanghai’s Manufacturing Edge

Tao spotlighted what she called the strength of “Chinese intelligent manufacturing,” crediting the Shanghai Gigafactory with giving domestic consumers access to the “lowest price in the world” for the Model 3 and Model Y. She noted that Tesla works with more than 400 supply chain partners in mainland China and has introduced over 60 of those companies into Tesla’s broader global procurement system.

She said the factory’s efficiency and cost structure enable Tesla to achieve high quality, strong productivity and competitive pricing, which benefits consumers not only in China but also in the Asia-Pacific and European markets that receive Shanghai-built exports.

Report Claiming Tesla Is Phasing Out China-Made Parts

A previous report from The Wall Street Journal claimed Tesla had started weaning its US-made cars off China-sourced parts. This change has been attributed to increased tariffs on Chinese goods and to ongoing supply chain issues that first emerged during the pandemic. It stated Tesla had already completed the swap for some parts and was working to complete the rest within one or two years. The report also said the company had encouraged several China-based suppliers to establish operations in Mexico and Southeast Asia to mitigate tariff risk and ensure more stable sourcing.

It added that fresh tension over automotive chips, including China’s temporary block on exporting Nexperia semiconductors used in lighting and electronics, had intensified Tesla’s urgency to diversify. The report further said Tesla had stopped using China-made LFP batteries in U.S. models after they lost eligibility for EV tax credits and became subject to tariff complications, prompting Tesla to pursue domestic LFP production in Nevada.

Stocktwits Traders Call For Tesla Breakout

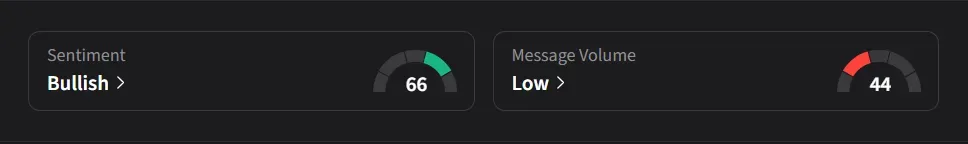

On Stocktwits, retail sentiment for Tesla flipped to ‘bullish’ from ‘neutral’ on Wednesday amid ‘low’ message volume.

One bullish user expects the stock to “open lower like $423 ish then break $430.”

Another user said, “time to pump this to $500 by end of year. Friday will be huge. Get it to $440.”

Tesla’s stock has risen 6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)