Advertisement|Remove ads.

Texas Instruments Stock Rises On Solid Q3 Results But Retail Sentiment Nosedives

Shares of Texas Instruments, Inc. ($TXN) climbed Wednesday morning after the Dallas-based chipmaker kickstarted U.S. semiconductor earnings with a quarterly earnings beat. The retail crowd, however, did not take kindly to the fourth-quarter guidance that fell below Wall Street forecasts.

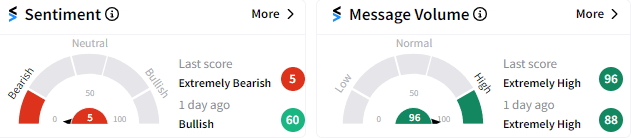

Retail sentiment, which was ‘bearish’ ahead of the earnings release, worsened to ‘extremely bearish’ with a score of 5/100 on Stocktwits as of 10:33 am ET. The move was accompanied by ‘extremely high’ message volume.

Retail traders were particularly concerned about the valuation of the stock after the mixed quarterly results.

TI reported earnings per share (EPS) of $1.47 for the fourth quarter, which includes a $0.03 benefit. Revenue fell 8% year-over-year but rose 9% sequentially to $4.15 billion. Analysts, on average, had modeled EPS of $1.38 and revenue of $4.12 billion.

All end markets, with the exception of industrial, reported sequential growth. Automotive segment reversed to sequential growth, thanks to strength in China, said CEO Haviv Ilan on the earnings call.

The deterioration in retail sentiment apparently stemmed from the guidance, which calls for fourth-quarter EPS of $1.07-$1.29 and revenue of $3.70 billion-$4 billion. This compares to the consensus of $1.33 and $4.04 billion, respectively, according to Yahoo Finance.

Analyst action following the earnings release was mixed, with BofA Securities lowering the price target for shares by $5, the Fly reported. Baird and Barclays also reduced their respective price targets by $25 and $10, respectively. On the other hand, Morgan Stanley and Evercore ISI upwardly adjusted their price targets by $13 and $30, respectively.

As of 10:33 a.m. ET, TI shares gained 3.85% to $201.45.

Read Next: Vertiv Stock Dips Despite Strong Beat-And-Raise Quarter: Retailers Maintain Bullish Outlook

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)