Advertisement|Remove ads.

Texas Instruments’ Retail Sentiment Hits 3-Month High As CEO Reassures Readiness To Sift Through Semiconductor Cycle

Texas Instruments Inc. (TXN) CEO Haviv Ilan stated on Wednesday that the company is well-prepared with sufficient supply on hand as the chip industry navigates its typical fluctuations.

“The semiconductor cycle is playing out. Cyclical recovery is continuing while customer inventories remain at low levels. In times like this, it is important to have capacity and inventory, and we are well-positioned,” remarked Ilan in the second-quarter (Q2) earnings call.

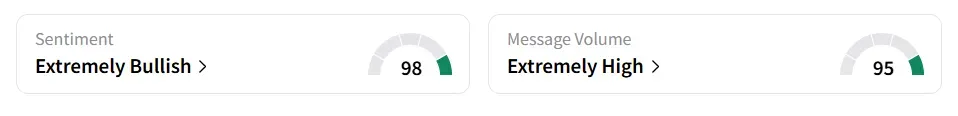

Texas Instruments experienced a 2,700% increase in Stocktwits message count over the last 24 hours. Retail sentiment toward the stock improved to ‘extremely bullish’ (98/100) from ‘bullish’ territory the previous day.

Message volume jumped as well, to ‘extremely high’ (95/100) from ‘high’ levels in the last 24 hours. Both retail sentiment and message volume hit a three-month high.

Texas Instruments stock traded over 12% lower on Tuesday morning.

Stocktwits users said they are buying the dip in the stock.

Texas Instruments’ Q2 revenue climbed 16% year-on-year (YoY) to $4.45 billion, beating the analysts' consensus estimate of $4.32 billion, as per Fiscal AI data.

Analog revenue, which made up 78% of the overall total, rose 18% YoY, while embedded processing revenue saw a smaller increase of 10% YoY.

The earnings per share (EPS) of $1.41 also surpassed the consensus estimate of $1.37.

Morgan Stanley analyst Joseph Moore cut the firm's price target to $197 from $205 while maintaining an ‘Underweight’ rating, as per TheFly.

The analyst noted that although the June quarter outperformed expectations, driven by strength in industrial, personal electronics, and communication infrastructure, the 4% growth forecast is described as “seasonal at best.”

Texas Instruments' stock has gained 0.4% year-to-date and declined 5% over the past 12 months.

Also See: Alphabet Gets Price Target Boost Ahead Of Q2 Print: Retail Says ‘Google Is So Undervalued’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)