Advertisement|Remove ads.

This AI-Driven Real Estate Stock Surges Up To 36% Premarket: Here’s Why Retail Chatter Exploded Nearly 200%

reAlpha Tech Corp. (AIRE) experienced an explosion in Stocktwits retail chatter after the company finalized its public offering announced earlier in 2025.

On July 18, reAlpha, a company that applies artificial intelligence to real estate, announced that the total funds from the offering, before subtracting placement agent commissions and other related costs owed by the company, amounted to roughly $2 million.

The news sparked interest among retail traders with a 195.8% surge in message counts in the last 24 hours. reAlpha stock traded over 36% higher in Monday’s premarket.

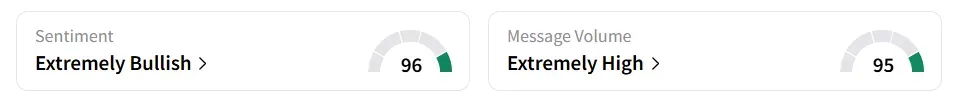

Retail sentiment around reAlpha remained in ‘extremely bullish’ (96/100) territory, at a six-month high, amid ‘extremely high’ (95/100) message volume.

A user noted that the stock is gaining traction due to expected growth, increasing revenue, pent-up housing demand, and a potential rate cut.

reAlpha issued about 13.3 million shares of its common stock, bundled with Series A-1 and Series A-2 warrants, each allowing holders to purchase an equivalent number of additional shares.

Each share and accompanying warrants were priced collectively at $0.15 per unit.

reAlpha plans to allocate the net funds toward several initiatives, including operating expenses, debt repayment, potential acquisitions, and technology investments.

The company also indicated that part of the proceeds could be used to acquire digital assets, consistent with its standing cryptocurrency investment strategy.

The company’s first-quarter (Q1) revenue of $0.93 million beat the analysts' consensus estimate of $0.7 million, as per Fiscal AI data. Loss per share of $0.06 matched the consensus estimate of a loss of $0.06.

reAlpha held $1.2 million in cash and equivalents as of March 31. The stock has lost over 93% of its value year-to-date and more than 87% in the last 12 months.

Also See: Pinterest Sees Surge In Retail Buzz As Ad Efficiency Drives Morgan Stanley Upgrade

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)