Advertisement|Remove ads.

Pinterest Sees Surge In Retail Buzz As Ad Efficiency Drives Morgan Stanley Upgrade

Pinterest Inc. (PINS) experienced a surge in Stocktwits retail chatter after Morgan Stanley adopted a more optimistic outlook and upgraded the stock.

The research firm raised the stock’s rating to ‘Overweight’ from ‘Equal Weight’ on July 20, and also bumped up its price target to $45 from $37, as per TheFly.

The new price target implies a potential upside of roughly 21% from the stock’s last closing price.

Following the upgrade, discussions among retail traders about Pinterest increased in the last 24 hours.

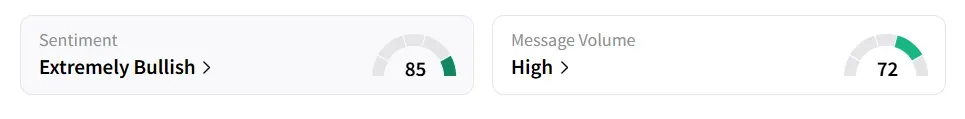

Pinterest stock traded over 4% in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ (84/100) territory with ‘high’ (72/100) message volume levels.

The reassessment comes as analysts at the brokerage express optimism about Pinterest’s ability to enhance its revenue model and profitability in the latter half of 2025.

Morgan Stanley cited promising signals from advertising industry checks pointing to gains in ad targeting and campaign performance.

According to a CNBC report, Morgan Stanley analyst Brian Nowak cited valuation appeal, underestimated revenue growth, and improving user engagement as key reasons for the renewed enthusiasm.

Nowak noted that Pinterest has been making consistent progress with its GPU (graphics processing unit)-enabled capabilities, which aim to enhance user experience and monetization tools.

The brokerage expects the advancements to yield a top-line growth of 17% to 18% in the second half of 2025, surpassing broader market expectations, according to the report.

Pinterest is an image-driven platform designed for exploration, idea curation, and product discovery. The San Francisco-based company serves a global audience with more than 500 million active users each month.

Pinterest stock has gained over 27% year-to-date and has shed over 9% in the last 12 months.

The company is expected to release its financial results for the second quarter 2025 on Thursday, August 7, after the closing bell.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)