Advertisement|Remove ads.

Titagarh Rail Bags Fresh Order, But Continues To Consolidate Below ₹1,000: SEBI RA Saurabh Sahu

Titagarh Rail Systems shares rose over 1% on Monday after securing a fresh ₹313 crore order from Indian Railways.

The company announced that it received a Letter of Advance Acceptance (LOA) from the Ministry of Railways for the manufacture and supply of 780 BVCM-C wagons, valued at approximately ₹312.69 crore. The contract is scheduled for completion within nine months and adds meaningful visibility to the company’s near-term revenue pipeline.

SEBI-registered analyst Saurabh Sahu noted that this order highlights Titagarh’s continued role as a key player in India’s railway infrastructure development, particularly within the bulk freight segment. It also strengthens the company’s order book at a time when the broader industrial outlook remains somewhat cautious.

On the technical charts, Titagarh stock has undergone a sharp correction over the past year, declining from levels near ₹1,950 (July 2024) to stabilize around ₹900–₹950 in recent months. Following this substantial decline, the stock has entered a sideways consolidation phase between ₹880 and ₹950.

Technically, ₹975–₹1000 remains a key resistance zone, according to Sahu. A breakout above this level could signal a reversal towards ₹1,100–₹1,150. However, a breakdown below ₹880 could expose the stock to further downside, potentially reaching ₹800.

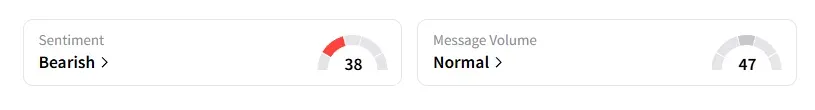

Since volumes currently suggest neutral sentiment, and the stock awaits fresh triggers to initiate a trend, he has no recommendation at this time. While the latest railway order supports sentiment, a sustained recovery in earnings will likely be needed to break the ongoing consolidation phase, Sahu concluded.

Data on Stocktwits also reflected this outlook, with retail sentiment remaining ‘bearish’.

Titagarh shares have declined 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)