Advertisement|Remove ads.

TMC Stock Draws Retail Buzz After CFO's Warning To Short Sellers

- Speaking at the Rock Stock Channel podcast, CFO Craig Shesky said, “If I were short the stock right now, I would be quite nervous."

- He said that if all regulatory roadblocks are cleared, TMC could start production even before its stated timeline, the fourth quarter of 2027.

- TMC shares have fallen by more than 17% in November and remain on course for the worst monthly decline since July last year.

The Metals Company (TMC) stock drew retail attention on Wednesday after the deep-sea mining firm’s Chief Financial Officer, Craig Shesky, warned that short sellers could be positioned for a “very bad day” amid government backing for the industry.

Speaking at the Rock Stock Channel podcast, Shesky said, “If I were short the stock right now, I would be quite nervous.” The stock jumped nearly 24% in extended trading after rising 7% in the regular trading session. According to MarketWatch data, 13.7% of the firm’s float is being held by short sellers.

What Else Did Shesky Say?

In April, U.S. President Donald Trump signed a sweeping executive order to accelerate deep-sea mining operations, part of a broader effort to counter China's dominance in critical mineral supply chains. The order aimed to fast-track the extraction of minerals, such as nickel, copper, and rare earth elements, from the ocean floor. These resources are vital to the production of electric vehicle (EV) batteries, wind turbines, and other clean-energy technologies.

Shesky said the company expects a string of positive news before adding that it is in talks with various stakeholders in the U.S. government, including the Department of Energy and the Pentagon, and believes that if all regulatory roadblocks are cleared, TMC could start production even before its stated timeline of the fourth quarter of 2027.

“While I can't point to a timeline or promise a specific headline, what I can say is that anybody who would be short the stock now, I would question what exactly is the thesis? When you're talking about roughly 25 million shares short, you are positioned potentially for a very bad day if some good news does come,” he added.

Warnings Come Amid Recent Performance

TMC shares have fallen by more than 17% in November and remain on course for the worst monthly decline since July last year. The stock hit new all-time highs in October after a flare-up in trade tensions between the U.S. and China over rare earth exports. The shares have scaled back after the two countries extended a trade truce and after its third-quarter results, in which the company reported a net loss of $184.5 million, compared with $20.5 million in the year-ago quarter.

However, Dmitry Silversteyn, senior research analyst at Water Tower Research, noted after the earnings report that with over $100 million in cash on hand and the possibility of $430-plus million from existing warrants, the company was not in immediate need of funds, perhaps for the first time since going public.

“Given the fact that we are in a strong cash position and given the fact that we are on a very clear path towards regulatory certainty, I don't quite understand what the bet against this would be,” Shesky said.

What Are Stocktwits Users Saying?

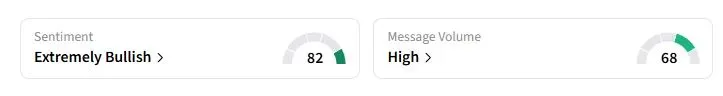

Retail sentiment on Stocktwits about TMC shares was in the ‘extremely bullish’ territory compared with ‘bullish’ a day ago.

“Deep sea mining will become a sector of its own and will separate from the mining industry because we do not mine, we harvest. This is much bigger than we can imagine,” one trader said.

“It is genuinely safer to let a 5-year-old play with matches than it is to go short on TMC,” another user wrote.

TMC Stock has risen more than fivefold this year amid a broader rally in rare-earth stocks.

Also See: Thanksgiving Gridlock: FAA Pauses Flights At Major Airports As Travel Surge Hits Peak

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)