Advertisement|Remove ads.

T-Mobile Stock Hits Record High, Retail Sentiment Stays Strong Despite Downgrade

T-Mobile US, Inc. ($TMUS) shares were on track to notch their sixth straight session in the green on Friday, hitting a record high and boosting retail sentiment, even as a Wall Street analyst raised some concerns.

Scotiabank downgraded T-Mobile from ‘Outperform’ to ‘Sector Perform’. However, it has raised its price target to $236, up from $215.50.

The brokerage believes T-Mobile's medium-term outlook remains strong due to its leading subscriber growth, rising service revenue, and increasing free cash flow compared to other U.S. telecom companies.

However, after the stock's strong performance in recent months, Scotiabank thinks the potential for short-term gains may be limited.

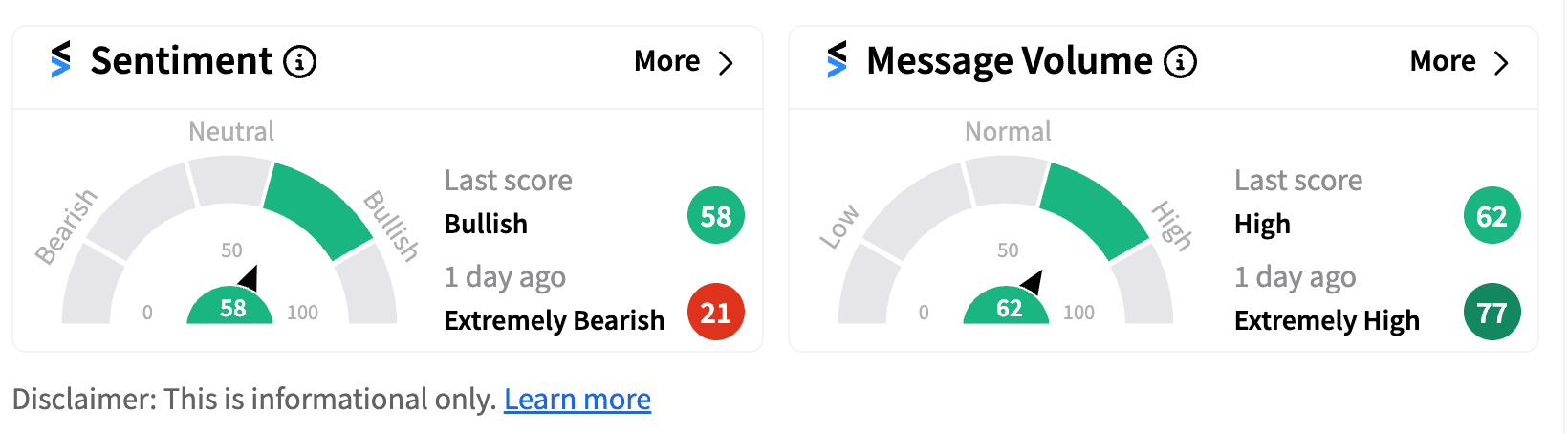

Retail sentiment on Stocktwits has flipped to ‘bullish’ (58/100) from ‘extremely bearish’ a day ago.

T-Mobile is also likely to benefit from United States Cellular's (USM) decision to sell a portion of its spectrum licenses, including a $1 billion agreement with Verizon and additional sales to other mobile network operators.

This move aligns with UScellular's strategy to monetize spectrum that wasn't included in its proposed sale to T-Mobile.

As UScellular completes these transactions, T-Mobile is expected to gain valuable spectrum assets, further strengthening its competitive position in the telecom market.

T-Mobile’s stock has gained 37% in 2024 so far and 59% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com.

Read more: CVS Shares Plunge Pre-Market as Leadership Change Fails to Uplift Retail Sentiment

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228842139_jpg_e44e80d81a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213366817_jpg_504ce4c75a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)