Advertisement|Remove ads.

ARM Shares Garner Street Attention After Q3 Earnings — What’s The Consensus?

- New Street analyst Pierre Ferragu upgraded Arm to ‘Buy’ from ‘Neutral’ with a $145 price target, representing an upside of about 28.6% compared to current trading levels of $112.78 at the time of writing.

- Ferragu said that Arm reported a 4% royalty beat in fiscal Q3 and that is what really matters, the analyst told investors, according to TheFly.

- RBC Capital analyst Srini Pajjuri cut the company’s price target to $130 from $140 while maintaining an ‘Outperform’ rating on the shares.

Arm Holdings Plc. (ARM) stock was in the spotlight on Thursday as the company received attention from Wall Street analysts after posting third-quarter (Q3) 2025 earnings on Wednesday.

New Street, RBC Capital, Bank of America, and Mizuho were among analysts who revised their outlook and price targets on the firm.

Shares of ARM gained over 7% on Thursday at the time of writing.

Street Consensus

New Street analyst Pierre Ferragu upgraded Arm to ‘Buy’ from ‘Neutral’ with a $145 price target, representing an upside of about 28.6% compared to current trading levels of $112.78 at the time of writing.

Ferragu said that Arm reported a 4% royalty beat in fiscal Q3 and that is "what really matters," the analyst told investors, according to TheFly. The analyst added that market fears of a weak 2026 for smartphones are "overdone" as the premium segment is unaffected, adding that the post-earnings pullback reflects temporary concerns about smartphones and creates an entry point, while the company’s datacenter segment will contribute meaningfully to growth.

Meanwhile, RBC Capital analyst Srini Pajjuri cut the company’s price target to $130 from $140 while maintaining an ‘Outperform’ rating on the shares, as per TheFly. The analyst cited a slower Q4 royalty growth outlook, even though the management sounded confident about sustaining 20% growth in FY27, the analyst said in a research note, as per TheFly.

BofA lowered Arm’s price target to $115 from $120 and maintained a ‘Neutral’ rating on the shares, citing the company’s results that showed in-line to modestly better-than-expected Q3 results and Q4 guidance.

Mizuho also lowered the firm's price target to $160 from $190 and kept an ‘Outperform’ rating on the shares. The analyst said that it views Arm's growth as solid, and recommended buying the post-earnings pullback in the company’s shares.

Earnings Update

Arm posted a 26% year-on-year growth in quarterly revenues, clocking $1.24 billion in Q3 2025, and beating street expectations of $1.23 billion. The company said that its royalty revenue increased 27% year-over-year due to growth across its target end markets such as artificial intelligence, data centers, smartphones, physical AI, and edge AI.

The company reported adjusted profit of $0.43 per share, beating street consensus of $0.41 per share.

Providing forward guidance, Arm said it expects Q4 revenues to come between $1.42 billion and $1.52 billion, compared to street expectations of about $1.44 billion on average.

How Did Stocktwits Users React?

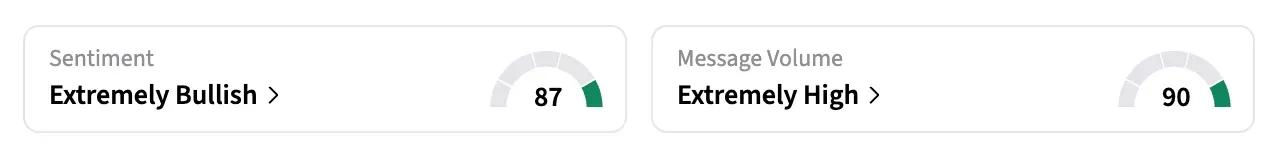

On Stocktwits, retail sentiment around ARM shares jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours. Meanwhile, message volumes increased from ‘high’ to ‘extremely high’ levels.

One bullish user said the company has value and reaches the world’s devices.

Shares of ARM have declined by over 34% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Michael Burry Flags Wording, Methodology Updates In Google Parent Alphabet’s Fresh Filing

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)