Advertisement|Remove ads.

Torrent Pharma Nears Breakout; SEBI RA Lalit Mundhra Sees Bullish Setup Post Q4

Torrent Pharmaceuticals posted a steady set of numbers in the fourth quarter, reinforcing confidence in its growth trajectory and catching the attention of SEBI-registered analyst Lalit Mundhra, who believes the stock could be gearing up for its next bullish move.

For the March quarter, Torrent Pharma reported a 10.9% year-on-year rise in net profit to ₹498 crore, while revenue grew 7.8% to ₹2,959 crore.

The company’s EBITDA came in at ₹964 crore, up 9.2% YoY, with margins improving slightly to 32.6% from 32.2% a year ago.

During the post-earnings call, the company guided for double-digit revenue growth of 10–12%, exceeding industry growth estimates by 2–3 percentage points.

From a technical standpoint, Mundhra noted that the stock had entered a tight consolidation range between ₹3,240 and ₹3,360, following a strong uptrend from its March lows.

This sideways movement formed a rectangle pattern, which typically precedes a continuation of the prevailing trend.

The stock’s ability to hold above key Fibonacci retracement levels—particularly the 38.2% level at ₹3,179—has been viewed as a sign of underlying strength.

A bullish engulfing candle near ₹3,179, accompanied by a notable spike in trading volumes, suggests buyers are stepping in at lower levels.

While the immediate resistance remains at ₹3,360, Mundhra believes a decisive breakout above this level could signal the start of the next upward leg.

Conversely, a breakdown below ₹3,067 could indicate trend exhaustion and trigger selling pressure.

With strong earnings support and improving technical indicators, Torrent Pharma remains a stock to watch for traders and investors looking for breakout opportunities in the pharma space.

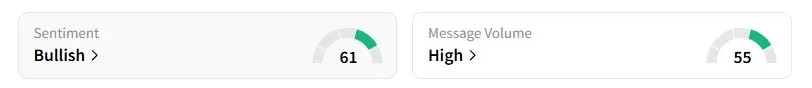

Data on Stocktwits shows retail sentiment on this counter is ‘bullish’.

Torrent Pharma shares have fallen 2% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)