Advertisement|Remove ads.

Torrent Power Acquires Newzone Firms For ₹211 Crore; Technicals Signal Caution

Torrent Power acquired stakes in Newzone firms, securing land for a new thermal power project in Madhya Pradesh. It has bought Newzone India (NZIPL) and Newzone Power Projects (NZPPPL) for a total of ₹211 crore.

The acquisition includes 49% equity shares of NZIPL & 100% equity shares of NZPPPL from the Sarawagi Family & related HUFs, and is likely to be completed in four months. SEBI-registered analyst Sameer Pande noted that this move indicates a strategic push to expand generation capacity.

Technical Outlook

On the technical front, Torrent Power stock is trading below key moving averages, indicating a bearish trend. The daily, weekly, and monthly supertrend indicators also display a sell or neutral signal, aligning with the price trending under short- and long-term averages.

Pande identified support at ₹1,232 and resistance around ₹1,272 and ₹1,284. Immediate demand zones are seen near ₹1,230–₹1,244, while supply zones emerge in the ₹1,270–₹1,290 band. He added that while there could be minor bounces from these supports, the underlying sentiment remains cautious unless the price convincingly reclaims ₹1,295.

Overall, he believes that the trend is weak, with short-term selling strength dominating, making ₹1,230–₹1,244 a critical demand zone and ₹1,270–₹1,290 a supply resistance zone in the near term.

What Is The Retail Mood?

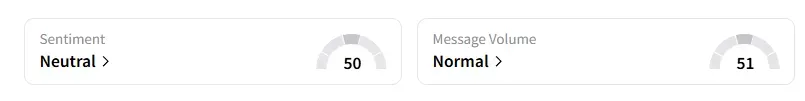

Data on Stocktwits shows that retail sentiment has been ‘neutral’ on this counter for many weeks.

Torrent Power shares have been under selling pressure this year, falling 15% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)