Advertisement|Remove ads.

Trent Slips On Slower Growth Guidance: SEBI RA Prabhat Mittal Sees Buying Opportunity

Trent shares slipped nearly 8% on Friday after the management flagged a warning about a slowdown in growth during their annual general meeting (AGM). This led brokerage firm Nuvama to downgrade its rating and revise the target price lower for Trent.

Trent management projected first-quarter (Q1 FY26) revenue growth of about 20%, which is lower than the 35% compound annual growth rate (CAGR) of the last five years, as well as their previous targets of maintaining over 25% growth in the coming years.

Analysing this cautious outlook, Nuvama downgraded the rating on Trent to ‘Hold’ with a revised target of ₹5,884. They have also reduced their revenue and EBITDA estimates for FY26 and FY27, citing concerns that the current growth rate does not justify the stock’s high valuation.

On the technical charts, SEBI-registered analyst Prabhat Mittal highlighted that after the stock tested an all-time high of ₹8,345 on October 14, 2024, it corrected nearly 46% and hit a low of ₹4,488 on April 7. Since then, Trent has regularly made higher highs and higher lows on the short term, which is a positive sign for the stock.

Ahead of this announcement, the stock was trading above its 20, 50, and 100-day moving averages (DMAs). After this news triggered a decline, the stock slipped below its 20 DMA, noted Mittal.

He suggested that traders can look to buy the stock at its current market price of ₹5,742, with a strict stop-loss of ₹5,480 (which is the last higher low). He has set a target price of ₹6,100 and ₹6,400.

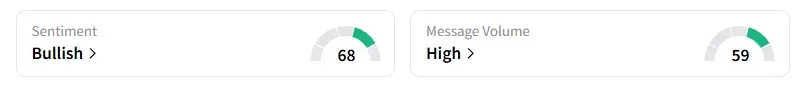

Data on Stocktwits shows that retail sentiment remained ‘bullish’ on this counter amid ‘high’ message volumes.

Trent shares have fallen 19% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)