Advertisement|Remove ads.

IDBI Bank Stake Sale: Four Bidders Reportedly Make The Shortlist

IDBI Bank’s shares gained more than 6% on Monday, after reports emerged that four bidders have been shortlisted to pick up a stake in the bank, in what could be a tightly contested process

Government To Divest Stake In IDBI

The four bidders will be looking to acquire the stake sold by the Indian government and LIC, which together hold a 60.7% stake in the lender. The divestment plan, first announced in 2021, was formally launched in October 2022.

According to an article by Moneycontrol, Dubai’s state-owned Emirates NBD, Fairfax India Holdings, Kotak Mahindra Bank, and US-based Oaktree Capital Management have been cleared by the Reserve Bank of India (RBI) to bid for the lender.

The report adds that Emirates NBD and Fairfax are showing strong interest and could emerge as front-runners. However, Kotak Mahindra Bank, which is likely to be completing its final round of due diligence, may also remain a serious contender.

Once the last round of diligence concludes, the Department of Investment and Public Asset Management (DIPAM) is likely to invite financial bids in October. If timelines are maintained, Finance Minister Nirmala Sitharaman has confirmed that the transaction is expected to be completed by March 2026, the report added.

Recently, SEBI approved LIC’s reclassification as a public shareholder, limiting its voting rights to 10% and requiring it to reduce its stake to 15% over two years.

Stock Watch

IDBI Bank’s stock has gained in six of the last seven sessions, adding over 10% during the rally.

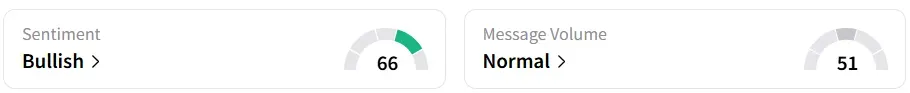

Retail sentiment for IDBI Bank on Stocktwits turned ‘bullish’ last week. Sentiment has largely been ‘bearish’ over the past year. In one year, the stock has gained 5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)