Advertisement|Remove ads.

Retail Investors Have A Completely Different Take On Truist Financial Corp And Fifth Third Bancorp Post Earnings

After major banks kickstarted the earnings season with upbeat sets of earnings, Truist Financial Corp and Fifth Third Bancorp are now attracting retail interest following their latest quarterly results announcements. Here’s a look at how these lenders performed during the quarter and how retail investors are perceiving the numbers:

1. Truist Financial Corp: The bank’s second quarter earnings topped analyst estimates with adjusted revenue coming in at $5.02 billion as compared to a Street estimate of $4.78 billion. Earnings per share (EPS) for the quarter stood at $0.91 as compared to an estimate of $0.82. Net interest income, the difference between interest earned and interest expended, came in at $3.58 billion, slightly lower than the $3.66 billion recorded during the same quarter a year ago. Net interest margin (NIM) improved to 3.03% compared to 2.90% in Q2 of 2023. In line with the performance of other Wall Street banks, investment banking and trading income increased 35% YoY to $286 million during the quarter.

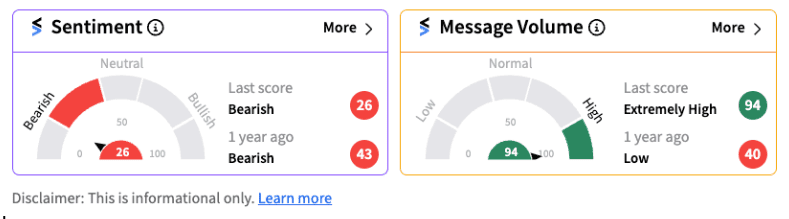

However, what appeared to have disappointed investors is the 32% fall in the bank’s net income at $920 million. Also, the bank reported securities losses of $6.70 billion ($5.10 billion after-tax), or $3.80 per share, from the strategic balance sheet repositioning of a portion of the available-for-sale investment securities portfolio. Following the announcement, retail sentiment on Stocktwits dipped into the bearish territory (26/100) supported by extremely high message volume.

2. Fifth Third Bancorp: The lender, which is one of the largest banks in mid-western US, reported a 5% year-over-year (YoY) decline in its GAAP net interest income at $1.39 billion during the second quarter. Earnings per share came in flat at $0.81 but missed a Street estimate by four cents. Net interest margin fell to 2.88% in Q2 as compared to 3.10% in the same period a year ago.

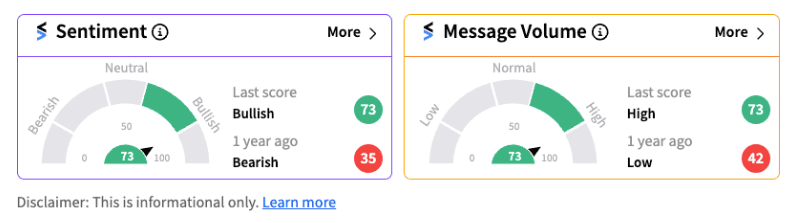

However, the bank said this is the first quarter that witnessed sequential NII growth since 2022. For the third quarter, the bank expects a sequential improvement of about 2% in its NII and a 1-2% rise in its non-interest income as well. Meanwhile, a DA Davidson analyst raised the target price on the stock to $42 from the previous $39 while maintaining a ‘Neutral’ stance on the stock. Following the announcements, retail sentiment was trending in the bullish territory (73/100), supported by extremely high chatter.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)