Advertisement|Remove ads.

Trump Says ‘Too Late’ Powell Must Cut Rates Now, And ‘Bigger Than He Had In Mind’ Ahead Of Fed Meeting This Week

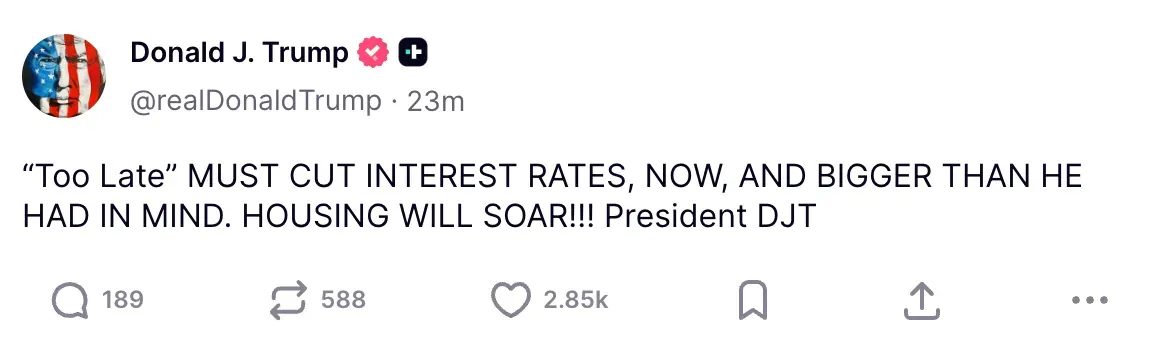

President Donald Trump on Monday called on Federal Reserve Chair Jerome Powell to cut interest rates “now,” and by a bigger quantum than expected.

In a post on Truth Social, President Trump stated that an interest rate cut would provide a boost to the housing sector.

“‘Too Late’ MUST CUT INTEREST RATES, NOW, AND BIGGER THAN HE HAD IN MIND. HOUSING WILL SOAR!!!” Trump said.

President Trump’s post comes two days ahead of the Federal Reserve’s interest rate decision. Data from the CME FedWatch tool now points to an 83.3% probability of the Fed cutting interest rates by 25 basis points in September.

Meanwhile, not everyone is on board with the 50 bps rate cut train. Carlyle Group’s co-founder and co-chairman, David Rubenstein, said that a 50-basis-point interest rate cut would scare the markets about the state of the U.S. economy. “It will have to be 25 basis points. If the Fed were to go 50 basis points, it would scare the markets that the economy is weaker than what the markets think it is, and I think it would be too much for the market to absorb,” Rubenstein said.

On Monday, Ed Yardeni, founder of Yardeni Research, said that while the markets are “hoping” for a 25 bps cut, Wall Street would be “pleasantly surprised” by a 50 bps cut. However, he expressed concerns that this could drive up the markets and valuations “too quickly.”

Meanwhile, U.S. equities edged up in Monday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.45%, while the Invesco QQQ Trust (QQQ) rose 0.64%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up 0.18% at the time of writing.

Also See: Trump Says Companies Would No Longer Be ‘Forced’ To Report Earnings Quarterly – More Details Inside

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233231242_jpg_8d76eb3b7a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sarepta_cf8e97de31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)