Advertisement|Remove ads.

Trump Media Stock In Spotlight As Q1 Loss Narrows, Retail's Upbeat

Trump Media & Technology Group Corp. (DJT) shares showed a muted reaction in Friday's post-market session after the media company, which is majority owned by President Donald Trump, announced its quarterly results.

The Sarasota, Florida-based company reported combined interest income and revenue of $8.8 million for the first quarter of the fiscal year 2025. Net sales increased to $821.2 million from $770.5 million reported for the year-ago quarter.

The company said its operating cash outflow during the quarter was $9.7 million, and it incurred $10.9 million in legal fees, including costs related to its special purpose acquisition vehicle (SPAC) merger in March 2024.

The net loss was $31.7 million or $0.14 per share, narrower than the year-ago loss of $327.60 million or $3.61 per share.

The net loss included $19.6 million in non-cash expenses for stock-based compensation, depreciation, and amortization. Trump Media & Technology Group (TMTG) reported an operating loss of $39.5 million.

The company had reported a loss of $400.87 million for the fiscal year 2024.

The parent of the Truth Social platform ended the quarter with a cash position of $759 million.

TMTG said it focused on building its ecosystem, improving its existing platforms, and diversifying into financial services in the first quarter. The company completed the launch of its Truth.Fi branded exchange-traded funds (ETFs) and customized separately managed accounts (SMAs).

It adopted a financial services and fintech strategy that includes investing up to $250 million, to be custodied by Charles Schwab, in assets including Truth.Fi's own financial products, cryptocurrencies, and other securities.

The company launched an app to stream Truth+ content on Roku television sets alongside numerous other connected TV brands.

TMTG's stock also debuted on the NYSE Texas, in addition to its listing on the Nasdaq.

In a letter to shareholders, CEO and Chairman Devin Nunes said, "Ultimately, we envision Trump Media evolving into a larger holding company for numerous great assets, compatible with America-First principles, spanning across multiple key sectors of the economy."

President Donald Trump, through a revocable trust, owns 114.75 million shares of TMTG, representing 52% of the outstanding shares.

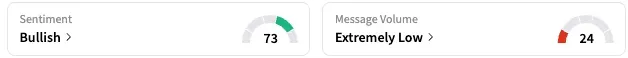

On Stocktwits, TMTG stock elicited a 'bullish' reaction (73/100) from users by late Sunday, although the message volume was 'extremely low.'

Much of the optimism expressed by users on the Trump Media stream is due to the progress in the U.S.-China trade talks.

Trump Media stock ended Friday's session down about a percent but rose 0.24% in the after-hours session. The stock is down 27% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)