Advertisement|Remove ads.

Tesla Analysts Turn Cautious Amid Stock Slide: Retail Confidence Sags On Musk’s DOGE Drama

Shares of Tesla, Inc. dropped in premarket trading Monday, extending a 6% decline over the past week, as a couple of Wall Street analysts sounded caution about the EV giant’s stock.

If Monday's losses hold, the stock is on track for its fourth consecutive day of declines.

Stifel lowered its price target on Tesla to $474 from $492, maintaining a 'Buy' rating, citing mixed fourth-quarter (Q4) results, uncertainty from the Trump administration, and declining favorability ratings for Tesla.

Despite this, Stifel highlighted key positives, such as a record-low Q4 cost of goods sold per unit, a lower-priced vehicle launch, and optimism around Optimus production ramping in 2025.

However, the analyst cautioned that pricing headwinds and stiff competition from Chinese EV makers could weigh on near-term sales.

Needham also downgraded its stance to 'Hold,' noting that Tesla's longer-term growth prospects around FSD (Full Self-Driving), Robotaxi, and robotics were likely already priced in.

Despite some momentum with autonomous rideshare and the Optimus bot, Needham sees Tesla as an expensive stock, trading at a premium while "operating from a trailing position" in autonomous rideshare and robotics.

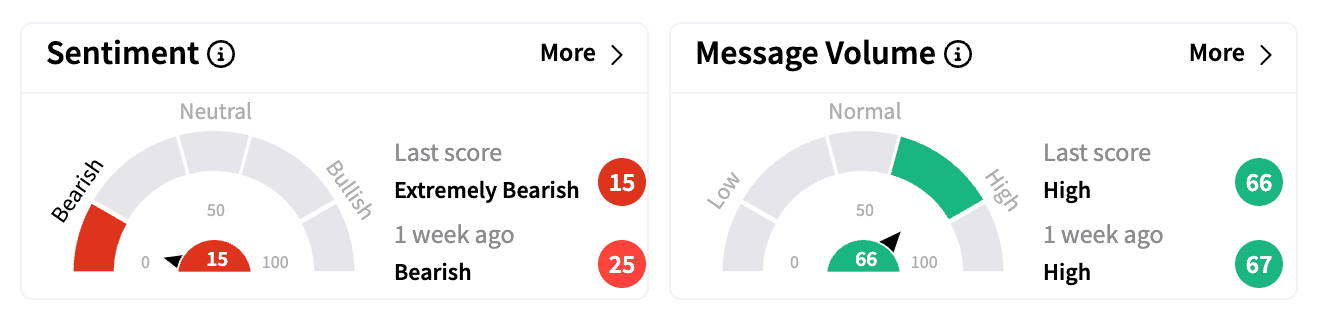

On Stocktwits, sentiment for Tesla stock remained 'extremely bearish' (15/100), with a jump in posts criticizing CEO Elon Musk.

One user said Musk "has ruined the image of Tesla with his actions and words," leading to many distancing themselves from the company.

Another user expressed concerns over Musk's growing unpopularity due to his political ties, adjusting their buy-in point to $330-$340 instead of $350.

Retail sentiment has become increasingly negative, as Musk's political ties and involvement in Donald Trump's DOGE (Department of Government Efficiency) initiative have drawn criticism.

Tesla's recent earnings miss and weak sales data in Europe and California — which some have linked to Musk's political stances and ties to right-wing movements — have further dented investor confidence.

Trump's aim to roll back pro-EV policies and impose tariffs on Mexico and Canada are also causing jitters.

Musk's DOGE team has mainly focused on cutting agencies with small budgets, but its broader implications on Tesla's stock remain uncertain.

Tesla's 12-month gains now stand at 90%, though YTD losses have risen to 7.3% as sentiment weakens.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)