Advertisement|Remove ads.

Tesla’s Retail Sentiment Sinks To Year’s Low As Slumping European Sales, Musk’s Political Moves Weigh On Stock

Tesla, Inc. shares fell more than 3% on Thursday morning, hitting levels last seen about two months ago and heading for their worst weekly performance since mid-October.

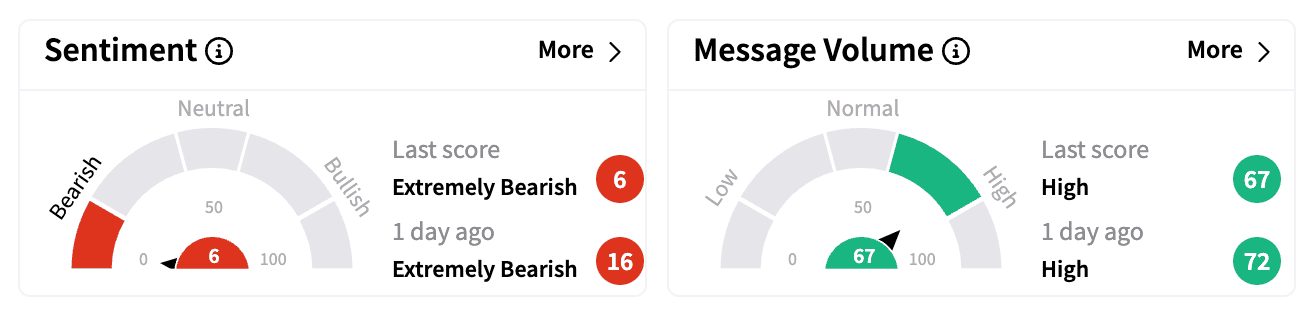

Retail sentiment on Stocktwits crashed to an ‘extremely bearish’ reading of 6/100, the lowest score in the past year, as investors reacted to a sharp drop in European sales and ongoing concerns about CEO Elon Musk’s political activities.

Data from Germany showed Tesla’s sales plunged 59% last month to 1,277 units, the lowest since July 2021. Sales have also declined in France and the UK, marking a downturn in Europe’s three largest EV markets.

Bloomberg reported that these numbers reinforced concerns that Musk’s political moves are damaging Tesla’s business.

His public endorsements of Germany’s far-right Alternative for Germany party, criticism of UK Prime Minister Keir Starmer, and close ties with former U.S. President Donald Trump — who has threatened tariffs on the European Union — have added to investor worries.

A Politico report citing internal polling from House Majority Forward, a group aligned with U.S. House Democratic leadership, found that most registered voters in battleground districts view Musk unfavorably.

The survey was completed before some of his more controversial moves as the leader of the Department of Government Efficiency (DOGE).

Investor frustration was evident on Stocktwits, with several bearish users blaming Musk’s political distractions for Tesla’s underperformance.

One retail trader pointed to Tesla’s sales declines in Europe, falling used car prices, and Musk’s lack of focus on the company as reasons for concern.

Another wrote, “Elon is doing everything else except running Tesla. And you fools think this stock will go up?”

Moreover, data from earlier this week showed Tesla’s California sales fell 8% in the fourth quarter, marking the fifth consecutive quarterly decline in the key U.S. market.

Investors are also bracing for potential policy shifts under Trump’s administration, including possibly ending the $7,500 EV tax credit, which could further impact demand.

However, some Wall Street analysts remain bullish.

On Monday, Piper Sandler reiterated an ‘Overweight’ rating on Tesla and maintained its $500 price target, arguing that the company is relatively insulated from the effects of Trump’s proposed tariffs against imports from Mexico, Canada and China.

Analyst Alexander Potter noted that Tesla assembles its most popular vehicles in the U.S., making it one of the most defensive stocks in the auto sector.

However, the brokerage trimmed its full-year vehicle delivery forecast to just under two million units, citing weaker European demand.

Tesla’s stock has gained about 93% over the past year but is down more than 6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)