Advertisement|Remove ads.

Tesla Bear Says 'Things Appear To Be Worsening' In China After Gloomy Insurance Data: Retail Grows Cautious

Shares of Tesla, Inc. (TSLA) ended Tuesday 4.9% lower, extending losses to a fourth consecutive session, as weak China data compounded concerns of investors already worried about a business hit from the new U.S. import tariffs.

Tesla China saw a sharp 82.6% drop in new vehicle registrations for the week ending April 6, with just 3,600 units registered, down from 21,000 the previous week, according to CnEVpost.

Meanwhile, Nio recorded 1,800 registrations, a 40% drop from the prior week's 3,000. Fellow Chinese EV-maker Xpeng logged a 21% weekly gain to 7,500 units, while Li Auto's tally slipped nearly 30% to 6,200 from 8,800.

According to The Fly, GLJ Research noted that data on China EV registrations for March 31 to April 6 meant Tesla "saw the largest WoW fall in Chinese auto registrations of the key Chinese EV bellwethers."

The research firm contended that "things appear to be worsening" in Tesla's "largest EV market" China and maintained a 'Sell' rating on the stock.

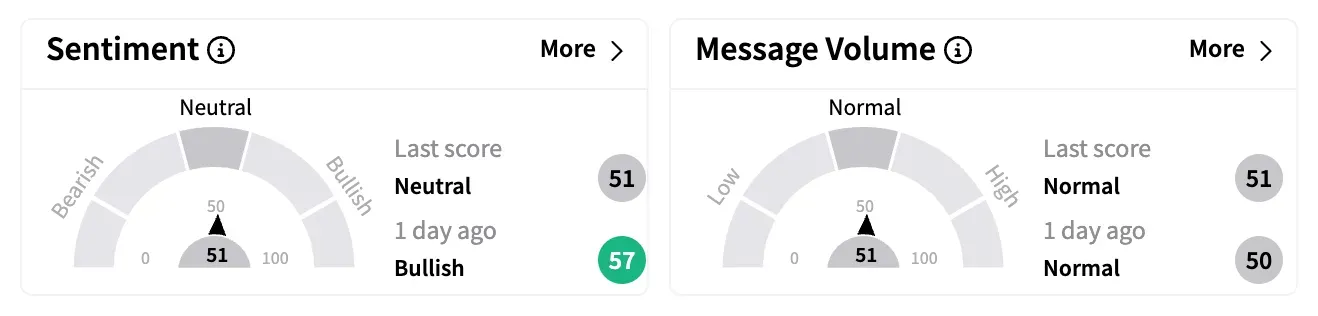

On Stocktwits, sentiment for Tesla dipped from 'bullish' to 'neutral' late on Tuesday, although message volume fell by 17%.

Reacting to the latest data, one user said the "Tesla boycotts have finally reached China" amid an escalating Sino-U.S. trade war.

One bearish watcher said the stock's fall amid the broader market weakness is "more like trying to catch a falling knife or watching a dead cat bounce."

Despite the steep week-over-week decline, Tesla China's latest figures indicate a 3% rise year-to-date and a 91.5% improvement over the first week of the second quarter of 2024.

Teslarati said this is a positive sign, given the Model Y production switchover at Giga Shanghai.

The factory reportedly prioritizes exports at the start of each quarter before pivoting to domestic deliveries.

Tesla stock has lost over 43% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2165533708_jpg_f85d1f9870.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_teladoc_logo_resized_f3ec80cc27.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)