Advertisement|Remove ads.

Tesla, Alphabet, Broadcom, Nvidia, Amazon: Why These 5 Mega-Cap Stocks Are Making Waves After Hours

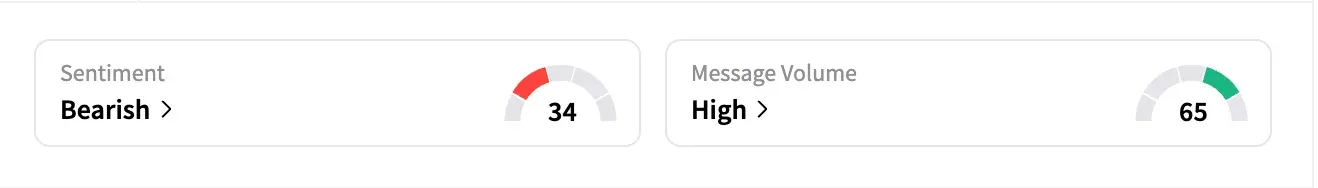

Tesla (TSLA): Shares fell over 4% after hours as the EV maker reported Q2 automotive revenue of $16.7 billion, down from $19.9 billion a year ago, marking its second consecutive quarterly decline. Both revenue and earnings per share (EPS) fell short of analyst expectations.

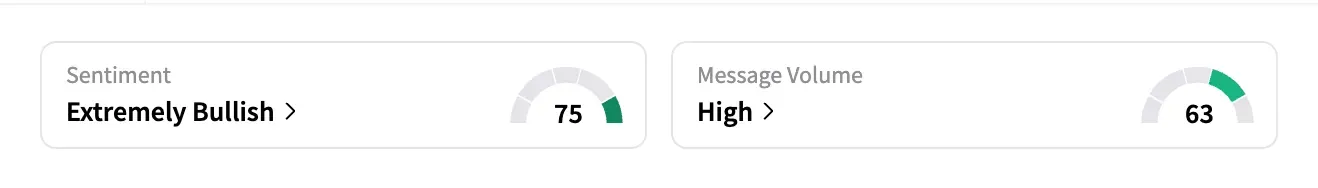

Alphabet (GOOG) (GOOGL): Shares rose 1.8% after the tech giant beat estimates, reporting Q2 earnings of $2.31 per share on revenue of $96.43 billion. Analysts polled by LSEG expected $2.18 per share and $94 billion in revenue.

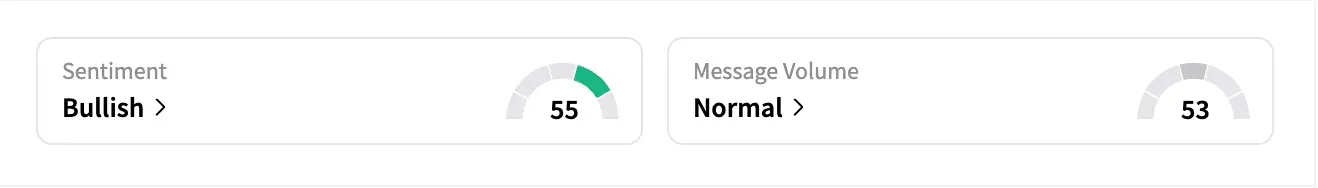

Broadcom (AVGO): The chipmaker gained 2.8% after reports from DigiTimes suggested it's competing with other firms for Meta's (META) new ASIC (application-specific integrated circuit) projects.

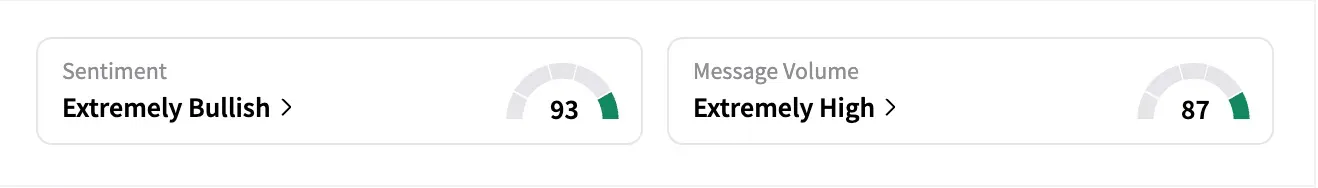

Nvidia (NVDA): Shares added 1.2% after-hours, boosted by optimism around the Trump administration's new AI blueprint, which seeks to expand AI exports and relax regulations. Nvidia supplier SK Hynix also boosted sentiment after announcing a record profit and increasing its investment for 2025.

Amazon (AMZN): Shares climbed 0.7% after the company announced the acquisition of Bee, a wearable AI device startup. BofA raised its price target on Amazon to $265 from $248, citing stronger-than-expected Q2 retail data, FX tailwinds, and AI momentum. BofA now expects $164 billion in Q2 revenue and $17.8 billion in profit, both above consensus and within Amazon's guidance range.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: S&P 500, Dow Jones Hit Another Record High On Trump’s Trade Deal Momentum, AI Action Plan

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)