Advertisement|Remove ads.

Tesla Stock Gets A Lift From Trump's Auto Moves, But Insider Selling And German Sales Slump Keep Retail Bearish

Shares of Tesla, Inc. (TSLA) finished 2.6% higher on Wednesday, marking only their second gain since last week, as investors reacted to the U.S. administration's latest auto policy moves.

President Donald Trump's proposal to make interest on U.S.-made car loans tax-deductible and his decision to delay Mexico and Canada import tariffs for automakers complying with North American trade rules boosted shares of Tesla and its legacy competitors during the session.

Despite the rebound, retail sentiment remained deeply skeptical, and Tesla shares slipped in after-hours trading as negative headlines weighed on investor confidence.

Reports indicated that Tesla's German sales fell 76% in February to 1,429 vehicles, following a 60% decline in January. The sharp drop came as CEO Elon Musk openly supported a far-right political party ahead of national elections in the region.

The company also saw similar declines in Scandinavia and France.

Regulatory filings revealed that Tesla executives have been reducing their stakes in the company.

Tesla Director Robyn Denholm sold 112,390 shares on Mar. 3 under a pre-established trading plan, totaling $33.67 million in proceeds. Chief Financial Officer Vaibhav Taneja also sold 6,000 shares the same day, generating $1.78 million.

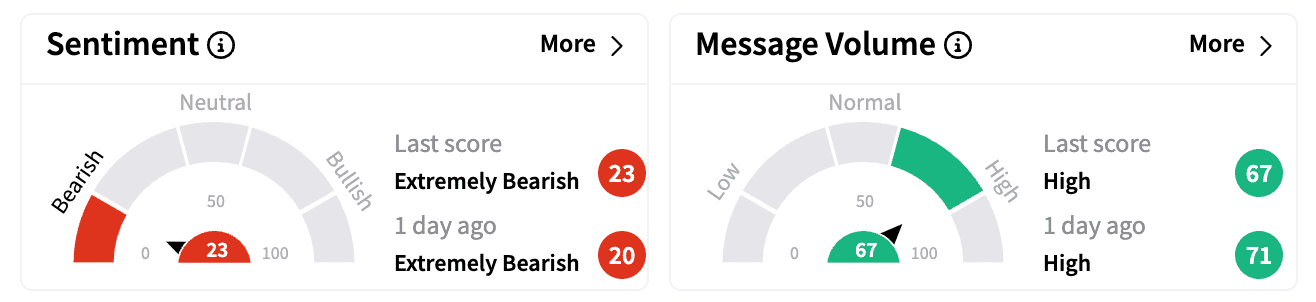

On Stocktwits, sentiment remained in an 'extremely bearish' zone, with message volume dropping more than 24% over the past week, suggesting growing skepticism among retail investors.

One user pointed to upcoming earnings risks, predicting that Tesla's first-quarter delivery numbers and financial results in April "should be fun to watch," adding that Musk will likely "come to the earnings call with a bunch of dreams like lies."

Another dismissed Tesla's newly introduced 0% APR financing and no-money-down lease options for the Model 3 as "pure desperation," arguing that consumer demand for the vehicle remains weak.

Still, Tesla had some positive catalysts heading into Thursday's session.

According to Electrek, the company secured a tax abatement agreement to build a new mega factory near Houston, Texas, for a battery storage facility.

Reuters reported that Tesla signed a lease to open its first showroom in Mumbai, marking a key step toward selling imported vehicles in India.

Tesla shares remain down more than 28% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)