Advertisement|Remove ads.

Tesla's Growth Woes Push BofA To Slash Price Target: Retail Bears Unmoved By Demand-Boosting Efforts

Bank of America Securities has reportedly cut its price target on Tesla, Inc. to $380 from $490, a more than 22% reduction, citing slowing growth and mounting risks.

According to The Fly, the research firm maintained a 'Neutral' rating on the stock and pointed to a sharp decline in European sales, uncertainty around its low-cost model launch, and concerns over the viability of its Robotaxi rollout.

BofA analysts now value Tesla's automotive segment 9 times EV/EBITDA (enterprise value-to-core earnings ratio), down from the previous 10 times in their sum-of-the-parts analysis.

The move reflects a more cautious outlook as competition intensifies in the electric vehicle sector and demand shows signs of weakening.

Tesla, however, has ramped up efforts to counter the slowdown. Business Insider reported, citing Tesla's website, that the company is offering free lifetime Supercharging to buyers of its Foundation Series Cybertruck in an attempt to boost interest in the pickup.

Meanwhile, Bloomberg reported that Tesla is advertising 0% APR (annual percentage rate) financing and no-money-down lease options for the Model 3 while also discounting older Model Y units ahead of a refreshed version's production ramp.

The Model X and Model S are reportedly being sold with lifetime Supercharging as well.

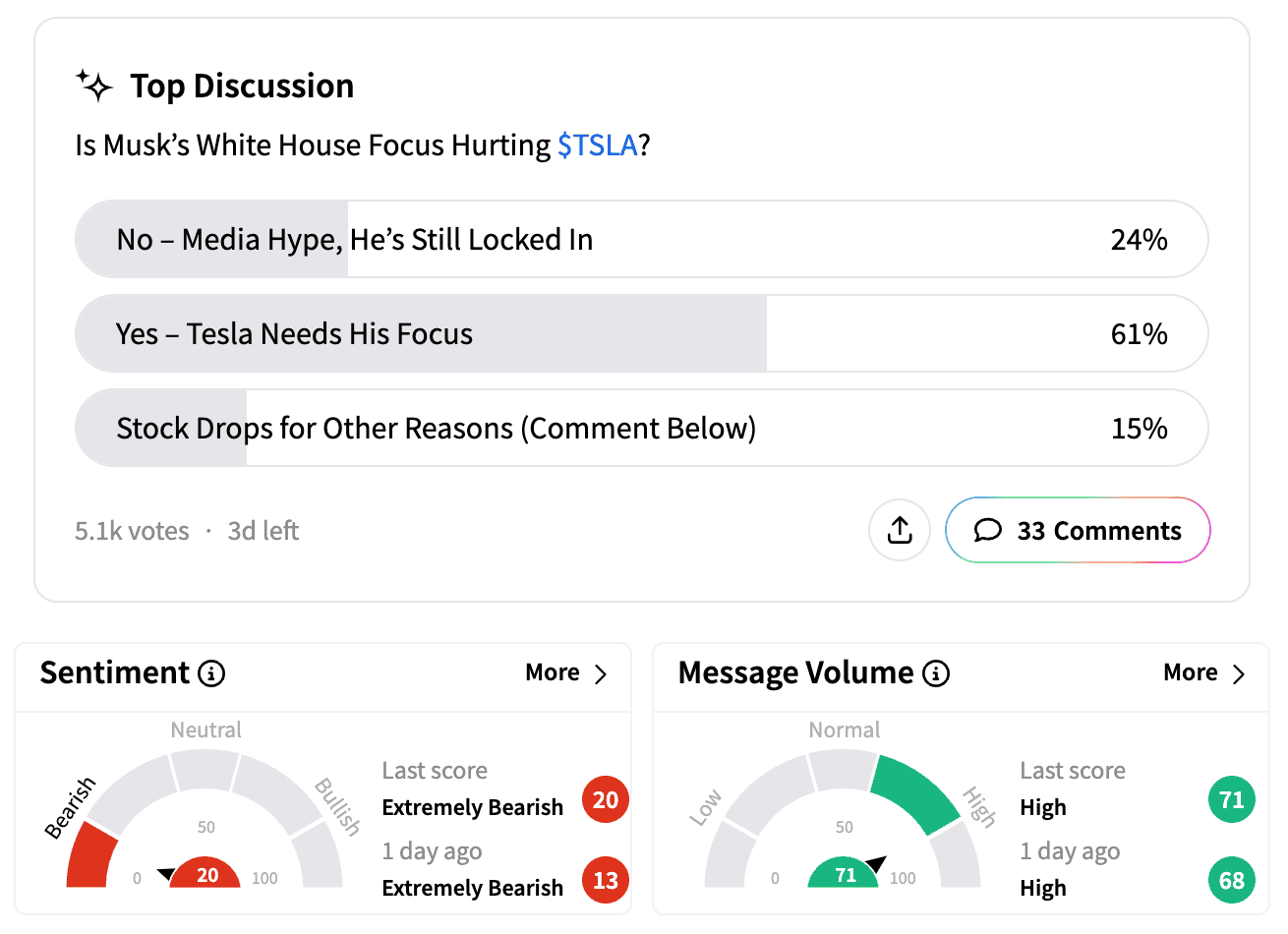

Despite these incentives, retail sentiment on Stocktwits remained largely bearish on Tuesday, continuing a trend that has persisted for the past week.

Traders have been debating the impact of CEO Elon Musk's recent involvement in President Donald Trump's administration, with some seeing it as an unwelcome distraction.

Others pointed to recent incidents, such as reports of a dozen Teslas being torched in an arson attack in France, as signs of growing hostility toward the brand.

Another user said Tesla "will be taken out by the competition within the next five years. This space is extremely competitive now."

Tesla faces renewed pressure in China, where preliminary data from the Passenger Car Association showed a 49% year-over-year decline in wholesale shipments for February.

The company delivered 30,688 vehicles from its Shanghai factory last month, a steep drop from the 63,238 units shipped in January. Meanwhile, China's BYD Co. extended its lead over Tesla in the world's largest EV market.

Tesla's shares are now down more than 30% year-to-date. The stock was up nearly 1.8% in Tuesday's after-hours trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)