Advertisement|Remove ads.

Twilio Stock Selloff Overdone, Says Morgan Stanley With An Upgrade — But Retail Disagrees

Twilio Inc. (TWLO) gained nearly 4% in Monday’s regular session after analysts at Morgan Stanley upgraded the stock’s rating and hiked their price target.

In a recent research note, Morgan Stanley upgraded the Twilio stock to ‘Overweight’ from ‘Equal Weight,’ hiking the price target to $160 from $144. This implies an upside of over 35% from Monday’s closing price.

“We are increasingly confident in crediting TWLO's execution toward double-digit growth and operating margin outperformance on the back of increased cross-sell,” the brokerage said, outlining its bull thesis for Twilio.

Twilio’s stock has fallen nearly 20% since its fourth-quarter results earlier this month. The cloud service provider delivered a mixed Q4 – its earnings missed expectations, while revenue barely edged past estimates.

However, Twilio’s guidance for Q1 sent the stock spiraling downwards—the company forecast earnings per share (EPS) of $0.88 to $0.93, while analyst estimates pegged it at $0.96.

Its revenue guidance of $1.14 billion is in line with estimates.

Morgan Stanley analysts believe that the selloff since then is “overdone” and that it actually creates an attractive entry point for investors.

The brokerage thinks Twilio will see estimated revisions going forward thanks to growth drivers like artificial intelligence (AI), product innovations, and go-to-market improvements in the coming months.

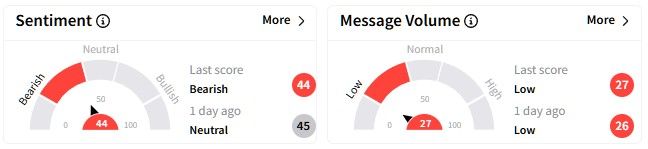

However, retail sentiment on Stocktwits around the Twilio stock tells a different story, with investors turning ‘bearish.’

One user was amused at Twilio stock receiving multiple price target hikes even as the shares hovered in the red in the past two weeks.

Despite the recent 20% selloff, Twilio’s stock has gained slightly over 9% year-to-date (YTD). It has more than doubled in the past year, gaining more than 104%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)