Advertisement|Remove ads.

UAL Stock Rises Premarket As CEO Flags Record Bookings And Strong 2026 Demand — Retail Calls It ‘Best In Breed For Airlines’

- CEO Scott Kirby said the past two weeks marked the highest booked revenue periods in the company’s history.

- Business travel demand has risen well into the double digits, with the five strongest business booking days occurring this month.

- Premium revenue increased 9%, while basic economy revenue rose 7%.

United Airlines Holdings Inc. shares rose nearly 4% in premarket trading on Wednesday after CEO Scott Kirby said the carrier has entered 2026 with strong demand momentum, citing record booking activity over the past two weeks.

Early 2026 Demand

In an interview with CNBC, Kirby said the last two weeks marked the first and second highest booked revenue weeks in the company’s history. He added that business demand is up well into the double digits, noting that the five biggest business booking days in United’s history have all occurred within the past two weeks.

Kirby said United tends to index more toward the premium segment, which has supported performance, but added that the airline remains focused on the entire aircraft and winning customer share across cabins. He said the main cabin is not performing as strongly as premium but is still doing well, and that United has been investing in that segment.

He said the airline recently announced it will offer hot meals in coach that customers can order in advance, adding that United is the only U.S. airline with ovens in coach.

Fleet Expansion And Capacity Plans

Kirby noted that United expects to take delivery of approximately 100 narrowbody jets and 20 widebody aircraft in 2026. He further noted that the 20 widebodies would be the highest number taken by a U.S. carrier in a single year since 1988.

He added that the move to the Boeing 787-10 is due to a market that can support higher-gauge aircraft, especially since the airline is facing capacity constraints at airports like Newark.

Strong Outlook Into 2026

The comments follow United’s upbeat outlook for the first quarter and full year of 2026 after reporting a fourth quarter that exceeded Wall Street expectations.

The company expects first quarter 2026 adjusted profit per share of $1 to $1.50, above an analyst estimate of $1.11 at the midpoint, according to data from Fiscal.ai. For full-year 2026, United projects adjusted earnings of $12 to $14 per share, compared with an analyst estimate of $13.07 per share.

Kirby told CNBC that the company guides conservatively and that current guidance is likely more conservative than normal. He said the airline is expecting a potentially record year on a profit basis if demand trends continue.

Q4 Review

For the fourth quarter, United reported adjusted diluted earnings per share of $3.10, above an analyst estimate of $2.94, according to Fiscal AI data.

Revenue totaled $15.4 billion, the highest quarterly revenue in the company’s history, beating expectations of $15.3 billion. The company said it flew a record 181 million passengers during the year, or an average of more than 496,000 per day. Total revenue per available seat mile declined 1.6% compared with the same quarter of 2024.

How Did Stocktwits Users React?

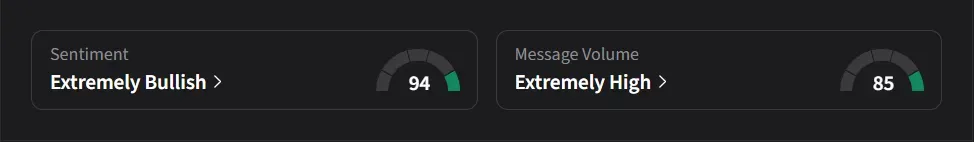

On Stocktwits, retail sentiment for United Airlines was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user, “I will say this $UAL has a great chance to run much higher to $160+ this year.”

Another user called UAL the “best in breed for airlines.”

UAL’s stock has risen 1.1% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)