Advertisement|Remove ads.

UBS Stock Rises After Jefferies Upgrade On Discounted Valuation: Retail Still Leans Bearish

U.S.-listed shares of UBS Group AG (UBS) rose 4.8% on Tuesday, tracking gains in Zurich, after Jefferies upgraded its Swiss shares to ‘Buy’ from ‘Hold’.

According to TheFly, Jefferies expects a "potential turning point" on the bank's capital and said there is an "adequate margin of safety in the shares" given the Swiss lender’s robust capital generation.

UBS topped first-quarter profit estimates in April, aided by its robust trading business. However, the bank’s shares have been under pressure due to the Swiss government’s efforts to require the lender to hold additional capital of up to $25 billion to avoid a fallout similar to that of Credit Suisse.

According to a Bloomberg report, the government is expected to propose increasing the bank’s ability to cover losses at foreign units to 100% of the capital in those units. CEO Sergio Ermotti has repeatedly warned that it could hinder the bank’s ability to compete with foreign rivals.

The analysts noted that shares are trading at a discount based on "worst case" outcome on capital and have been held back by about $50 billion in relative value terms since last April.

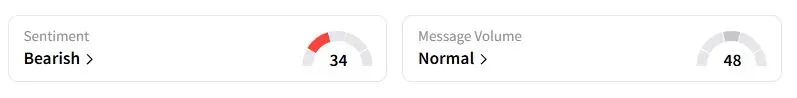

Retail sentiment on Stocktwits was in the ‘bearish’ (34/100) territory, while retail chatter was ‘normal.'

The bank had cut about 2,000 jobs during the first quarter as it continued to integrate Credit Suisse’s business following a government-backed takeover.

One of Credit Suisse’s units had agreed to pay $511 million in May to settle charges from the U.S. Justice Department, which said that the company had helped wealthy Americans evade taxes.

UBS stock has gained 10.2% this year.

Also See: Joby Aviation Stock Takes Flight As Retail Buzz Builds Around Potential $1B Saudi Air Taxi Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)