Advertisement|Remove ads.

UHG, COHN, AXL, MLAB: Retail Extremely Bullish On These 4 Stocks Amid Market Rout

As the broader market grapples with recession fears on Monday, a select group of stocks has managed to capture the attention and optimism of retail investors. Here’s how Stocktwits users feel about them as of 1:00 pm ET.

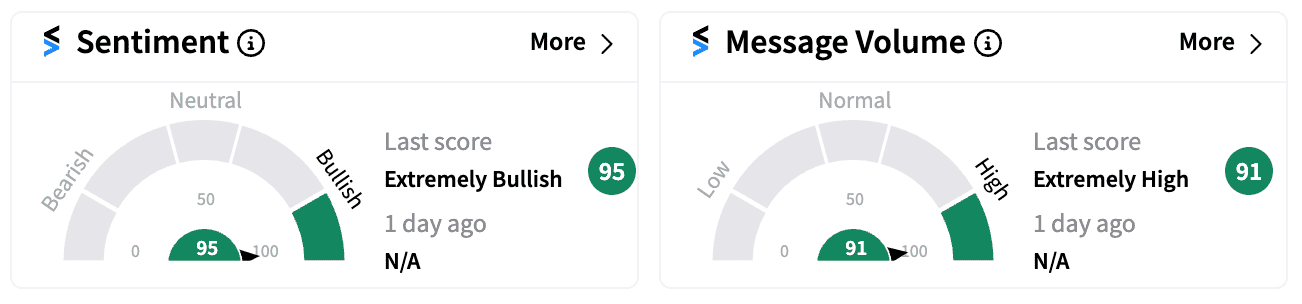

United Homes Group (UHG): Despite nearly 20% decline in its share price on Monday, UHG has garnered immense retail interest, with Stocktwits sentiment currently trending in the ‘extremely bullish’ zone (95/100).

The company, primarily focused on homebuilding in South Carolina, is set to release Q2 earnings on Thursday. While Q1 saw a decline in new home orders and backlogs, the average selling price increased 7% year-over-year to $335,000.

Notably, insiders made significant stock purchases in June, signaling confidence in the company's future.

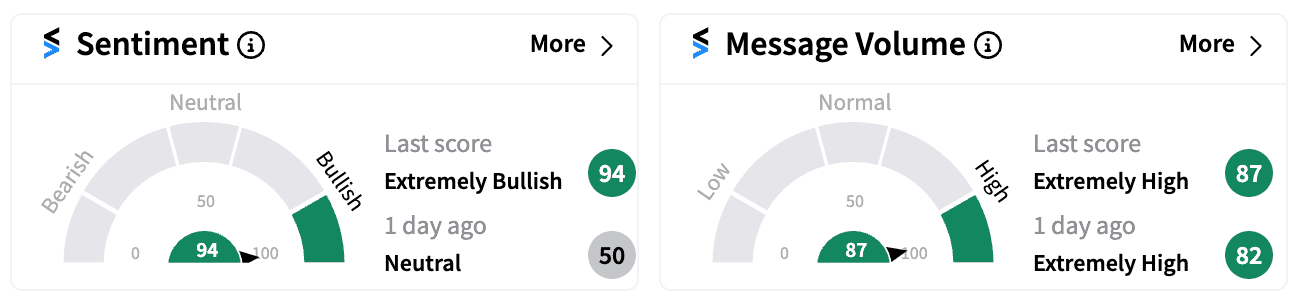

Cohen & Company (COHN): The wealth management firm has experienced a surge in retail optimism, with Stocktwits sentiment flipping to ‘extremely bullish’ (94/100) following its Q2 earnings report.

Despite adjusted loss widening to $1.51 per share from $0.30 in the prior year, the company emphasized its focus on enhancing long-term value and maintaining dividend payments.

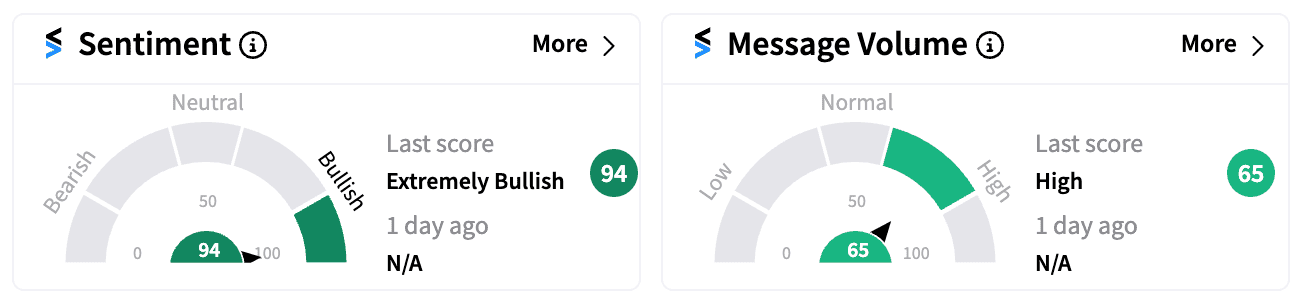

American Axle & Manufacturing (AXL): The driveline systems maker’s stock has garnered strong retail support despite a 4% decline in share price.

While BofA maintains an ‘underperform’ rating, citing macroeconomic challenges, retail investors appear optimistic about the company's ability to navigate industry headwinds.

The company is due to announce Q2 results on Friday, Aug. 9th, before the market opens, with Wall Street expecting EPS of $0.11. It has beaten EPS estimates in three of the past four quarters.

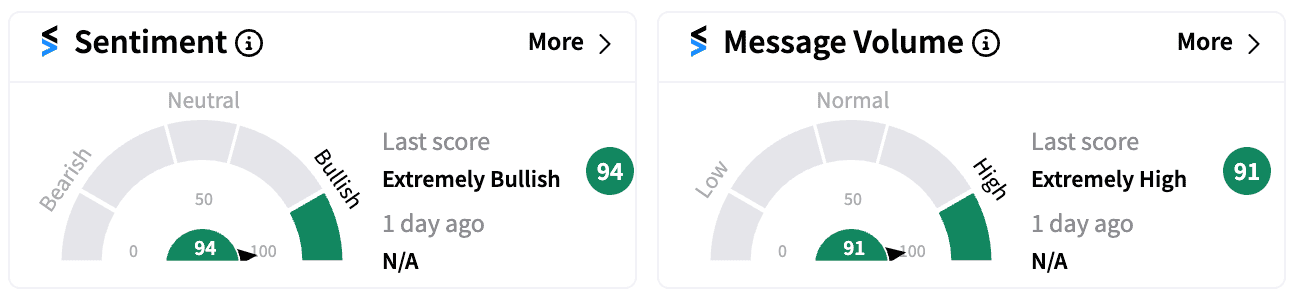

Mesa Laboratories (MLAB): The life sciences company has captured retail attention with ‘extremely bullish’ sentiment on Stocktwits. A strong Q1 earnings report, including a beat on EPS and debt reduction, has fueled investor optimism.

However, a recent price target cut by Evercore ISI to $106 from $120 might introduce some caution. The company's ability to maintain its strong financial performance will be essential for sustaining investor confidence.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)