Advertisement|Remove ads.

Ulta Beauty Downgraded At Argus As Macroeconomic Factors Cast Doubt Over Consumer Discretionary Spending: Retail Mood Neutral

Research firm Argus has downgraded Ulta Beauty (ULTA) stock to 'Hold' from 'Buy', according to The Fly.

In a recent investor note, the firm said Ulta is highly sensitive to economic factors, such as employment and wage growth, that impact discretionary spending.

The company's efforts to expand internationally also face risks due to the shifting U.S. trade policy, even as the beauty retailer faces tough competition from peers Sephora, Blue Mercury, and e.l.f. Cosmetics (ELF),

Argus analyst Taylor Conrad said Ulta's earnings outlook has turned negative, with a 1-year EPS growth forecast of negative 9.63%.

In the company's earnings report last month, management discussed plans to improve the layout and presentation of its stores and promote more wellness products and online sales.

Ulta forecasted full-year revenue between $11.5 billion and $11.6 billion and earnings per share of $22.50 to $22.90, missing analysts' targets on both parameters, according to Marketwatch.

CFO Paula Oyibo called the guidance cautionary at the time.

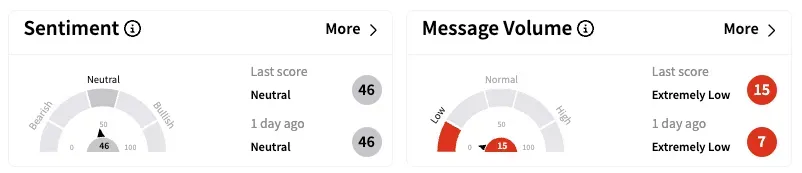

On Stocktwits, the retail sentiment was 'Neutral,' with 'extremely low' message volume.

Currently, 17 of 30 analysts rate the stock 'Hold' and 12 rate it 'Buy' or higher, according to Koyfin data. Their average price target is $412.13.

ULTA shares are down 17.8% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)