Advertisement|Remove ads.

Ulta Beauty Stock Dips On Disappointing Q2 And Outlook, But Retail Stays Bullish On Buffett Factor

Shares of Ulta Beauty Inc. (ULTA) slipped over 2% on Friday after the beauty retailer reported disappointing Q2 results and cut its full-year outlook. Still, retail investors remain optimistic, fueled by a recent high-profile endorsement from Warren Buffett’s Berkshire Hathaway.

Ulta reported a 1.2% decline in comparable sales for the second quarter, driven by a 1.8% drop in transactions, signaling a slowdown in consumer spending at its stores.

Quarterly net sales edged up 1% to $2.55 billion, falling short of the $2.62 billion expected by analysts. Earnings per share came in at $5.30, missing Wall Street’s estimate of $5.46.

The company now projects net sales between $11 billion and $11.20 billion, down from a prior guidance of $11.5 billion to $11.6 billion. Full-year EPS is now expected between $22.60 and $23.50, a significant cut from the previous forecast of $25.20 to $26.00.

“While we are encouraged by many positive indicators across our business, our second-quarter performance did not meet our expectations, driven primarily by a decline in comparable store sales,” said CEO Dave Kimbell.

The company’s market share is under pressure, particularly in prestige makeup and hair care, as competitors like Sephora ramp up store openings, including nearly 1,000 “store within a store” concepts at Kohl’s Corp locations.

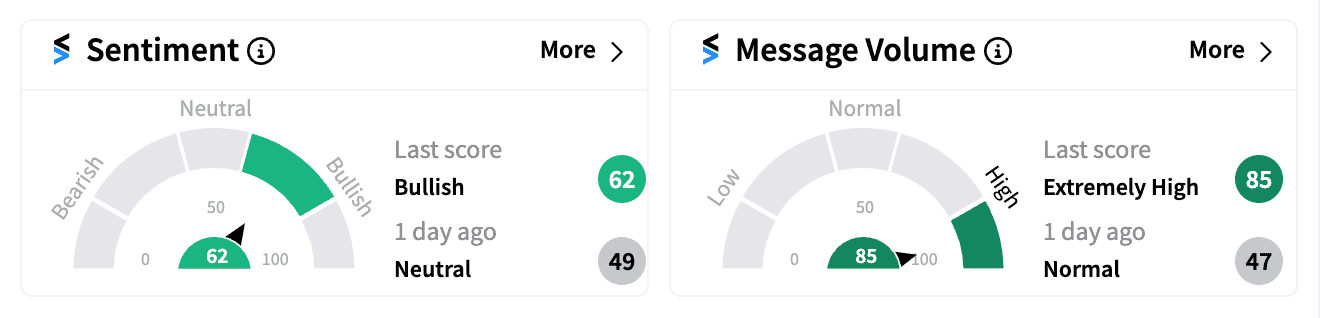

However, retail sentiment on Stocktwits turned ‘bullish’ (62/100) from ‘neutral’ just a day prior, riding on earlier news of Buffett’s Berkshire Hathaway buying 690,106 shares of Ulta in Q2, worth roughly $266 million as of the end of June.

Some pinned their hopes on Ulta’s growing online business and the upcoming holiday season spurring demand.

Wall Street’s response was mixed, with a slew of price target cuts and downgrades.

Stifel analysts, maintaining a ‘hold’ rating, cut their price target from $475 to $385, citing increased competition and shifting consumer behavior. They expect Ulta to scale back new store openings and update margin targets in an upcoming investor meeting in October.

BMO Capital also lowered its price target to $385 from $500, citing concerns over the company’s guidance cut. Still, analysts acknowledged that Ulta still operates a compelling business in an attractive sector.

D.A. Davidson sees the recent pullback as a buying opportunity, particularly for long-term investors like Buffett. “Ulta’s prestige share should start to rebound,” wrote analyst Michael Baker.

Ulta’s stock is down over 26% this year, underperforming the S&P 500 and the Nasdaq. But the Buffett factor appears to be a big stamp of approval for investors for now.

Read Next: TOVX Stock Jumps 30% As New Patent, FDA Designation Boost Investor Sentiment

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)