Advertisement|Remove ads.

UltraTech’s Stake Sale Lifts India Cements To Record High; SEBI Analyst Flags Momentum Triggers

India Cements shares hit an all-time high of ₹400 after its majority shareholder, UltraTech Cement, announced plans to sell up to 6.49% stake via Offer for Sale (OFS) to comply with SEBI’s minimum public shareholding norms.

India Cements surged up to 8% in afternoon trade on Thursday.

UltraTech Cement acquired India Cements in December 2024, and currently holds an 81.49% stake. The stake sale via OFS helps reduce the promoter holding and meet SEBI’s requirements. And the 6.49% stake sale will fetch ₹740 crore to UltraTech at the current price.

The OFS takes place over 2 days, with non-retail investors bidding on Thursday and the second day seeing retail investor participation. Floor price of the OFS has been fixed at ₹368 per share.

Analyst Take

SEBI-registered analyst Akhilesh Jat noted that strong buying interest has pushed the stock to a record high of ₹400. This rally reflects optimism on improved liquidity, regulatory compliance, and institutional participation, according to him.

Jat suggested that traders should track OFS pricing, subscription levels, and volumes, as these factors could influence momentum in the coming sessions.

What Is The Retail Mood?

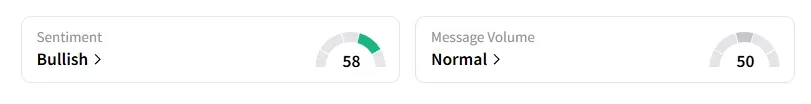

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter.

India Cements shares have risen 4% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)