Advertisement|Remove ads.

UnitedHealth Faces More Pressure As Bad News Mounts: JPMorgan Calls Pullback 'Overdone,' Retail Bulls Hang Tight

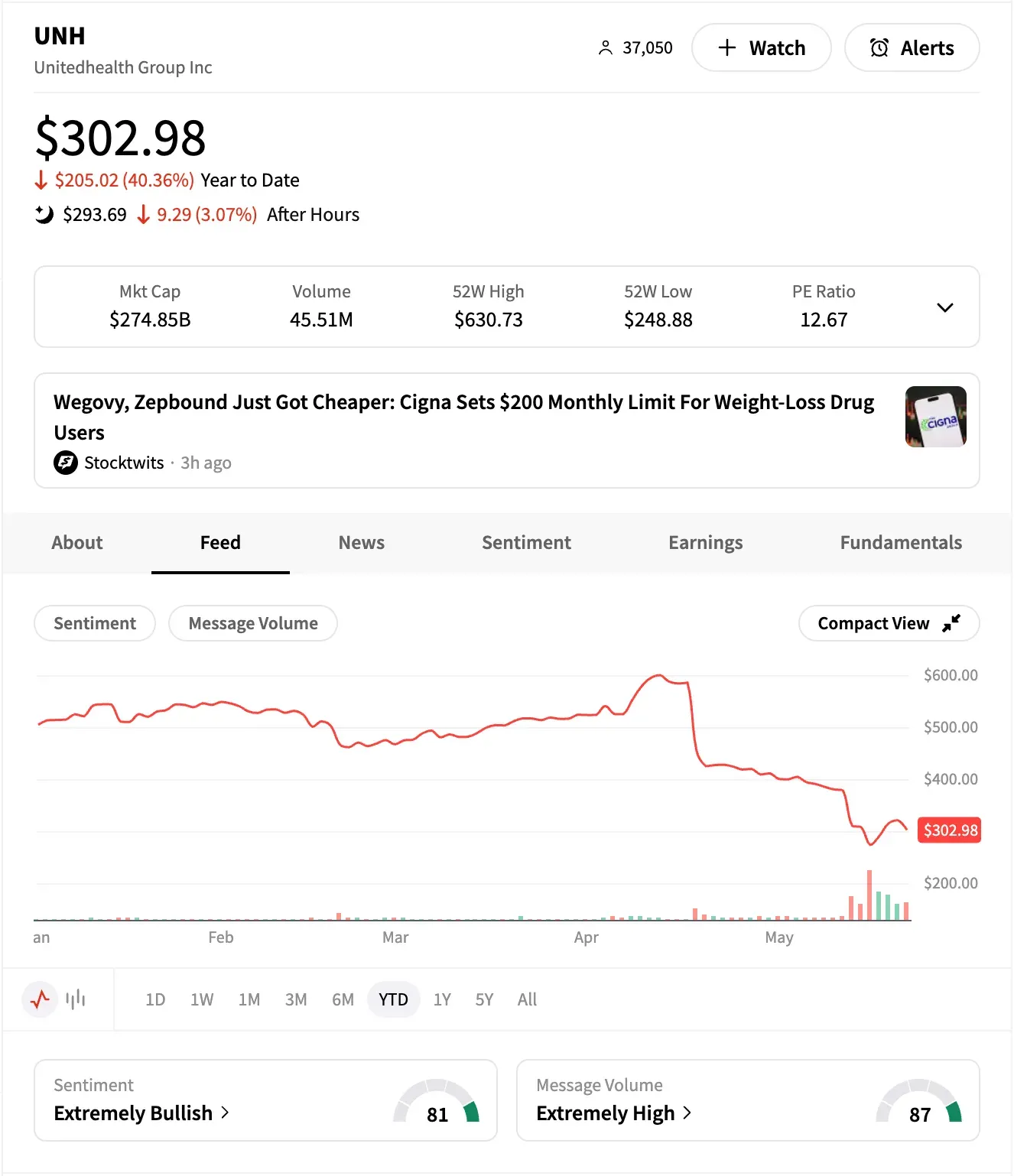

UnitedHealth Group Inc. (UNH) shares tumbled nearly 6% on Wednesday, snapping a three-day winning streak, as mounting legal and reputational headwinds weighed on investor sentiment.

The latest decline follows a damning report by The Guardian and growing concerns about an ongoing U.S. Department of Justice (DOJ) investigation.

According to The Guardian, UnitedHealth allegedly paid nursing homes to reduce hospital transfers as part of a cost-saving strategy that may have compromised resident care.

The report is based on confidential documents, whistleblower statements submitted to Congress, and interviews with over 20 current and former employees.

UnitedHealth has strongly denied the allegations. In a statement responding to the May 21 article, the company said, “The U.S. Department of Justice investigated these allegations, interviewed witnesses, and obtained thousands of documents that demonstrated the significant factual inaccuracies in the allegations.”

“After reviewing all the evidence during its multi-year investigation, the Department of Justice declined to pursue the matter,” the company added.

The report adds to the mounting scrutiny on UnitedHealth, whose stock was attempting to recover from a slide triggered by a Wall Street Journal story last week that the DOJ is conducting a criminal probe into possible Medicare fraud.

UNH stock is now down more than 39% year-to-date, the worst performer in the S&P 500, and the most oversold on the benchmark index with a Relative Strength Index (RSI) of 28.14.

Despite the setbacks, retail sentiment on Stocktwits has remained 'extremely bullish'. Message volume on UNH spiked 817% over the past month, with many traders shrugging off the negative headlines.

One user, identifying as a nursing home administrator, dismissed The Guardian's report as a "ridiculous claim," adding: "If that was the case, nursing homes would hold themselves liable to lawsuits for failure to appropriately take care of their residents… Just another way for this stock to get beat up."

Another user speculated the stock's steep slide was "intentional" as big investors will "move the money into healthcare and other safe investments after they're done selling off tech. It's recession proof and tariff proof. Guaranteed money."

Not all analysts are aligned. On Wednesday, HSBC downgraded UnitedHealth from 'Hold' to 'Reduce', slashing its price target to $270 from $490. Analyst Sidharth Sahoo cited executive turnover, guidance withdrawal, and unresolved Medicare fraud allegations for the downgrade, warning of continued downside risk.

However, JPMorgan pushed back, maintaining an Overweight rating on the stock. The firm downplayed The Guardian's reporting, calling the value-based contracts cited "relatively normal-course." JPMorgan added that the DOJ had previously investigated the issues without pressing charges and said the selloff was "overdone."

The firm's analyst, who has an 'Overweight' rating on UNH, believes The Guardian's reporting on nursing home payments and hospitalizations "misses the mark" and views Wednesday's movement as "overdone."

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)