Advertisement|Remove ads.

UnitedHealth Stock Drops On Report Of Paying Nursing Homes To Reduce Hospital Transfers: Retail’s In Wait-And-Watch Mode

Shares of health insurer UnitedHealth Group Inc (UNH) fell nearly 6% on Wednesday noon following a media report that the company secretly paid nursing homes thousands in bonuses to reduce hospital transfer for unwell residents.

The Guardian reported that the payments were part of a series of cost-cutting tactics that the company deployed while risking residents’ health.

The UK newspaper said that its investigation identified cases where nursing home residents did not receive the immediate hospital care they needed owing to the intervention of UnitedHealth staff deployed at the homes. At least one lived with permanent brain damage following his delayed transfer, the report said, citing confidential nursing home incident log, recordings, and photo evidence.

The scheme, Guardian said, helped the company pocket dollars from the government under Medicare Advantage plans while reducing its expense.

However, UnitedHealth said in a statement that the U.S. Department of Justice (DOJ) investigated these allegations and identified “factual inaccuracies” in them.

“After reviewing all the evidence during its multi-year investigation, the Department of Justice declined to pursue the matter,” it said.

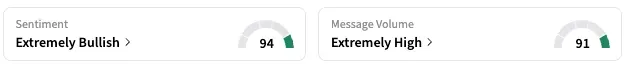

On Stocktwits, retail sentiment around UnitedHealth stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels.

UNH stock is down by about 40% this year.

A Stocktwits user expressed optimism for the stock moving back to near-$600 levels, last seen in April, over the coming months.

Another, however, opined that the stock has too many risk factors at the moment to be purchased at current price levels.

Meanwhile, HSBC analyst Sidharth Sahoo on Wednesday downgraded the stock to ‘Reduce’ from ‘Hold’ with a price target of $270, down from $490, as per TheFly.

The analyst noted that factors including the company’s recent CEO change, pulled 2025 full-year guidance, and alleged Medicare fraud has resulted in the company’s market cap halving since it reported first-quarter results last month.

The analyst opined that risks outweigh rewards at this juncture for the stock, which has dropped by over 42% over the past 12 months.

Also See: Coreweave’s Stock Jumps To New All-Time High After Citi More Than Doubles Price Target

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)