Advertisement|Remove ads.

US FDA Places Clinical Hold On Gilead Trials Of Two Investigational HIV Treatments: Retail’s On The Fence

Shares of Gilead Sciences, Inc. (GILD) traded over 1% lower on Tuesday noon after the company said that the U.S. Food and Drug Administration placed a clinical hold on its trials involving two of its investigational agents being developed for the treatment of HIV.

The two investigational agents, GS-1720 and GS-4182, have not been approved anywhere globally.

The clinical hold is due to the identification of a safety signal of decreases in CD4+T-cell (CD4) and absolute lymphocyte counts in certain participants receiving the combination of the two agents. Both CD4 T cells and lymphocytes are types of white blood cells that play a crucial role in the immune system.

Gilead said that it intends to investigate and pursue the potential of both agents and is committed to working with regulatory authorities to resolve the issues underlying the clinical hold.

Three additional early-stage trials of either agent and/or their combinations are also on hold, the company said.

However, the hold does not impact the multiple other long-acting oral and injectable investigational HIV treatment combinations under evaluation in clinical and preclinical studies, Gilead said.

Citi analyst Geoff Meacham termed the clinical hold a “minor setback” after noting that it does not affect Gilead’s other HIV programs, including its twice-yearly injection for preventing HIV infection, called Lenacapavir.

Citi keeps a ‘Buy’ rating on Gilead with a $125 price target.

Oppenheimer also said that it is "not sounding the alarm just yet" as the company "has a track record of resiliency in HIV drug development." Oppenheimer reiterated an ‘Outperform’ rating on Gilead shares.

RBC Capital, which remains neutral on Gilead shares with a ‘Sector Perform’ rating, acknowledged that the timing of the hold ahead of Lenacapivir’s anticipated approval date in mid-June is "not great, if FDA were trying to find some excuse to delay its approval.”

However, the clinical hold is "not insurmountable," the firm noted.

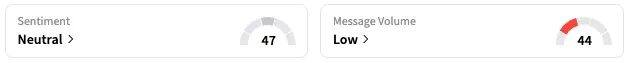

On Stocktwits, retail sentiment around Gilead rose from ‘bearish’ to ‘neutral’ territory over the past 24 hours while message volume remained at ‘low’ levels.

GILD stock is up by about 21% this year and by about 71% over the past 12 months.

Read Next: Tandem Diabetes Inks Deal With Abbott For New Diabetes Solutions: Retail Sentiment Stays Subdued

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)